In view of a significant drop in earnings after nine months, the German liner shipping company Hapag-Lloyd is expecting further tough quarters.

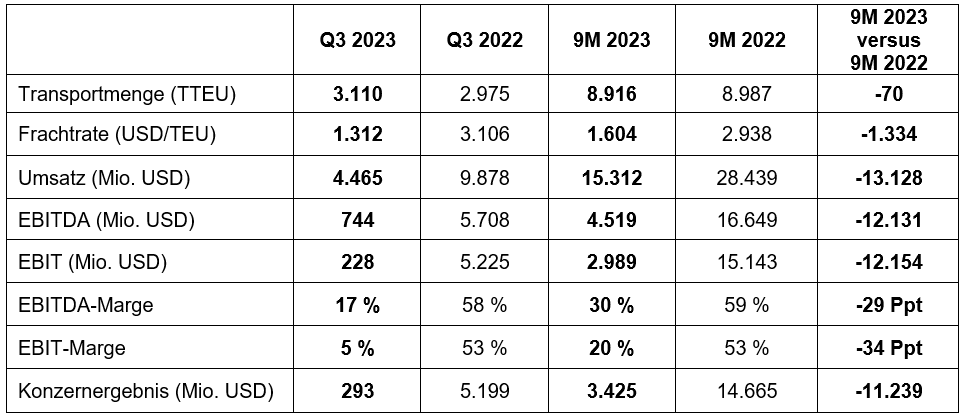

Despite increasing transport volumes in the third quarter, the Hamburg-based liner shipping company Hapag-Lloyd earned significantly less after nine months than in the previous year. Consolidated earnings fell by around 76% from $14.6 billion to $3.4 billion. [ds_preview]

Turnover almost halved from €28 billion to $15 billion in the period from January to September. The reason for this is the lower rate level following the boom during the coronavirus pandemic. While Hapag-Lloyd still received more than USD 3,000 per transported container (TEU) a year ago, the average rate in the third quarter of 2023 was only USD 1,300/FEU, which is still less than half.

Hapag-Lloyd continues to expect rough seas

The market turbulence is affecting all competitors. Maersk, for example, had previously reported similar heavy losses. The Danes announced rigid cost-cutting measures, which will result in the loss of around 10,000 jobs worldwide. The situation at Hapag-Lloyd is not (yet) that drastic, but savings are also being made. The liner network has already been thinned out and procurement is to be readjusted. CEO Rolf Habben Jansen is expecting further tough quarters if spot rates do not recover.

The revived cargo volume in the 3rd quarter gives hope. At 3.1 million TEU, even more was transported than in the same period of the previous year (2.9 million TEU). In a nine-month comparison, the figure is almost identical at around 8.9 million TEU. There was some relief for the result due to lower transport expenses (-11%) and lower bunker costs averaging USD 611/t (9M 2022: USD 755/t).

Hapag-Lloyd separates liner business from terminals

For the first time, Hapag-Lloyd is reporting its consolidated results separately for its shipping activities and the recently established terminal division. In the liner business, the shipping company generated revenue of USD 15.2 billion (9M 2022: USD 28.4 billion) and a profit (EBIT) of just under USD 3 billion compared to USD 15 billion in the previous year.

EBIT of USD 29 million is reported for the “Terminals & Infrastructure” business unit, in which Hapag-Lloyd bundles its investments in 20 port locations worldwide. However, this segment is still being established and therefore does not reflect the results of a full nine-month period, according to the statement.

For the full year 2023, the Hamburg-based shipping company is specifying the forecast it issued in March. EBITDA is now expected to be in a range of USD 4.5-5.5 billion and EBIT in a range of USD 2.4-3.4 billion. However, in view of the numerous geopolitical conflicts, the continuing inflationary pressure and the still high inventories of many customers, the forecast is still subject to a number of uncertainties.