More than six months after the start of the crisis in the Red Sea, the impact on container shipping is clearly noticeable.

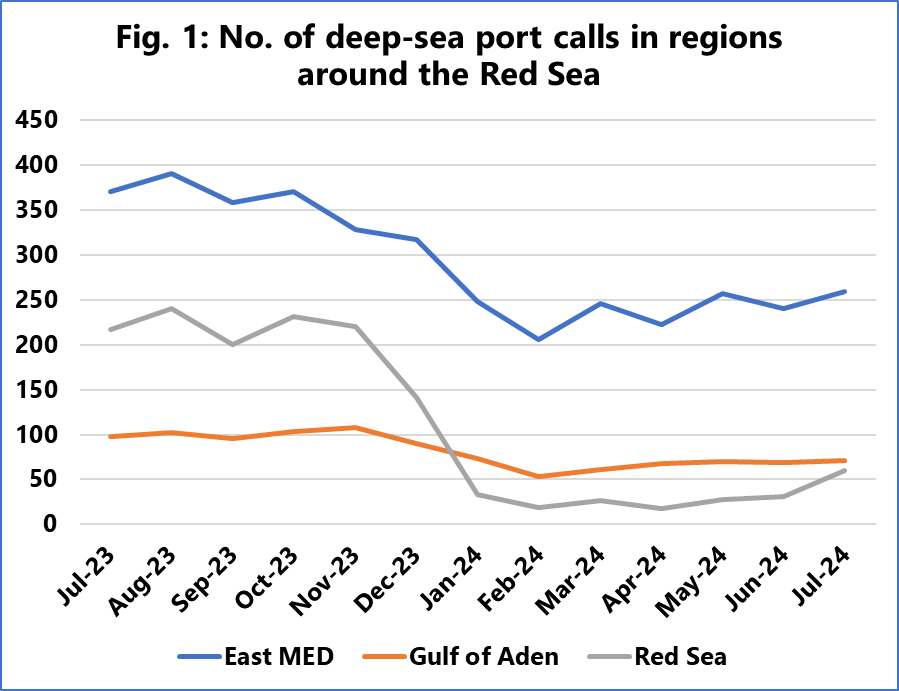

According to an analysis by Sea-Intelligence, port calls will fall by 85% by the end of the year. The Danish company analysed the monthly calls at deep-sea ports in the Eastern Mediterranean, the Gulf of Aden and the Red Sea.

While the total number of calls in the Eastern Mediterranean was already declining before the crisis, it fell particularly sharply in January by 22%. Compared to the pre-crisis average, the decline in 2024 was 33%, according to Sea-Intelligence.

A comparable decline of 33% in average monthly calls was observed in the Gulf of Aden, from around 100 to 60 to 70 in 2024. Port calls in the region are starting to improve, similar to the Mediterranean. However, both figures are only recovering slowly, as can be seen in the chart.

Red Sea remains a danger zone

The crisis is having the greatest impact on the Red Sea. For example, the Arab ports of Jeddah (since December 2023) and King Abdullah Port (January 2024) were no longer served by shipping companies. In Jeddah, monthly calls fell by 74% within six months. On average, the port is now only called at 37 times per month, compared to 135 calls before the start of the crisis in the Red Sea.

Although the decline was noticeable in the surrounding regions, it was less drastic. In the Eastern Mediterranean, the ports of Piraeus and Port Said were the hardest hit, while Salalah on the Gulf of Aden recorded a 50% decline in the period from January to February. Delays fell from an average of 10 to 14 days in January to “only” four to five days.

The effects of the conflicts in the Red Sea, triggered by attacks on merchant ships by the Yemeni Houthi militia, also had an impact on shipping far beyond the region. In June, for example, there were traffic jams lasting several days in Singapore, as the port was overloaded due to the rerouting of freight services and the associated longer travel times.