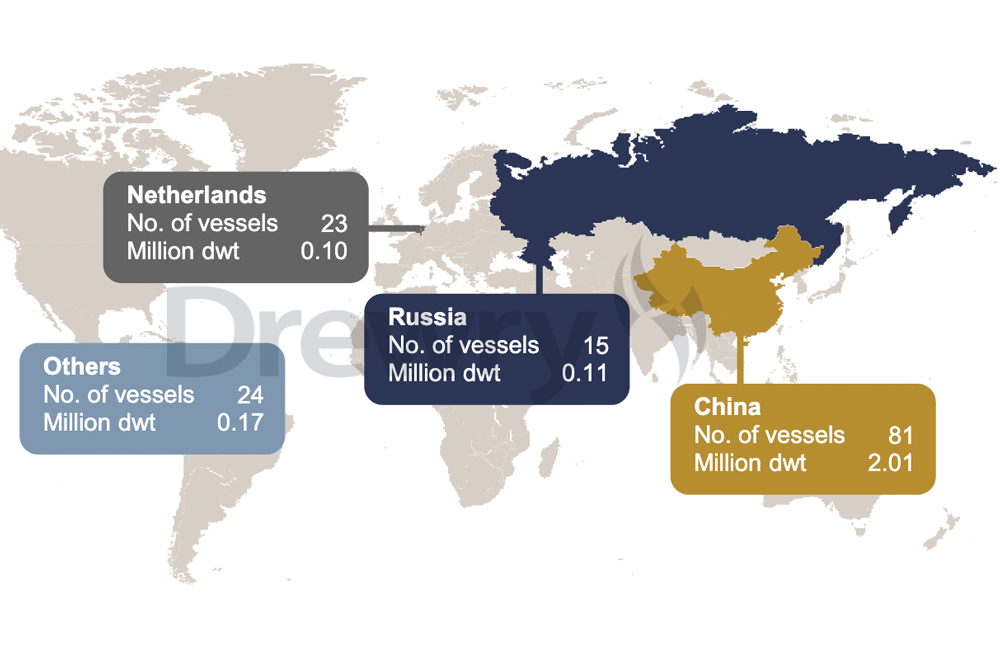

The order book for multi-purpose vessels (MPP) is dominated by China, both in terms of the number of ships and their construction. Experts see this as a risk.

Almost all larger ships in this sector are built exclusively in China. SAL has placed an order with the Wuhu shipyard together with Jumbo. The new AAL ships are being built at Guangzhou Wenchong and Briese has also placed orders in China, with Taizhou Sanfu.

This is not a new development, write the analysts at Drewry. However, the increasing geopolitical tensions between the USA and China could put fleet expansion and the charter market in a precarious position. [ds_preview]

MPP order book too small for demand

The order book for MPP newbuildings currently stands at just under 2.4 million GT. Unlike in container shipping, where numerous newbuildings are putting additional downward pressure on weak rates, relatively few ships have been ordered in the MPP sector. This has led to high fleet capacity utilization and rates that are still above the pre-coronavirus level.

If, as expected, freight demand picks up significantly from 2025 due to an increasing number of energy projects, a larger order book will be required to keep pace with developments. However, the focus on China could then become a problem, warns Drewry.

If geopolitical tensions increase and the situation around Taiwan escalates, there could be delays in the delivery of ships or the termination of contracts, depending on the severity of the situation. According to Drewry, only a few shipyards outside of China are capable of building large multipurpose freighters. Shifting orders to Japan, Korea or Europe would also make newbuilding prices drastically more expensive.