Bulker shipping companies are apparently facing a dent in the iron ore market. The reason for this lies in the discrepancy between expectations and reality regarding demand from China.

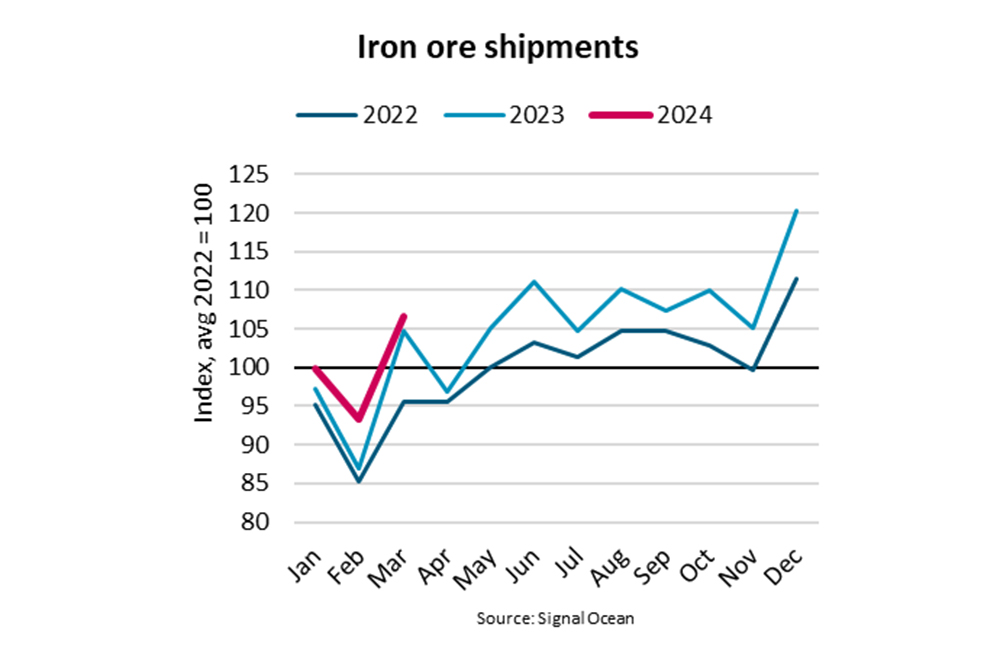

In the first quarter, global iron ore shipments rose by 3.8% year-on-year, although strong Chinese steel production was expected, which did not materialise, according to a recent analysis by the shipping organisation Bimco, which is mainly supported by shipowners.

The development could have consequences for the shipping industry: “The supply of iron ore has grown faster than Chinese demand, which could lead to weaker shipments,” says Filipe Gouveia, Shipping Analyst at Bimco.

At the beginning of the year, Brazilian iron ore shipments usually slow down due to mining disruptions caused by heavy rains. This year, however, conditions were better and Vale, a leading mining company, increased its production by 6% year-on-year, boosting shipments from Brazil.

In China, expectations of higher steel production after the Chinese New Year led to high iron ore prices. However, despite these expectations, steel production fell by 3.1% year-on-year, while both iron ore shipments and domestic mining increased. As a result, iron ore stocks in Chinese ports increased and are now at their highest level since April 2022.

73.9% of the world’s seaborne iron ore shipments go to China, as the country relies heavily on ore imports for steel production.

“The Capesize segment has benefited greatly from this increase in shipments, both due to the higher volume and the above-average routes between Brazil and China. This contributed to the Baltic Exchange’s Capesize 5TC Index reaching an average of US$24,286 per day, an increase of 165.6% year-on-year,” says Gouveia.

For iron ore shipments to increase further, Chinese steel production would need to recover, which could be supported by either stronger domestic demand or higher exports.

However, the crisis in the Chinese real estate sector has slowed both steel demand and economic growth in recent years. Unfortunately, leading indicators point to even weaker demand for the rest of 2024.

In the first quarter of 2024, real estate investment fell by 15% year-on-year and the floor area of newly constructed properties fell by 28.3% year-on-year. Demand for steel from the manufacturing and infrastructure sectors could continue to rise, but overall domestic demand is likely to stagnate, according to observers.

Abroad, the growing demand for steel could provide a sales market for Chinese steel products. In the first quarter of 2024, exports rose by 30.7% compared to the previous year.

“Even though iron ore shipments may slow down, we expect them to still increase by 1 to 2% in 2024, as the World Steel Association expects global steel demand to increase by 1.7%.” This could keep the Capesize segment strong, as the fleet is only expected to grow by 1.4% in 2024. A further increase in Brazilian mining would lead to longer distances and an even tighter market, says Gouveia.