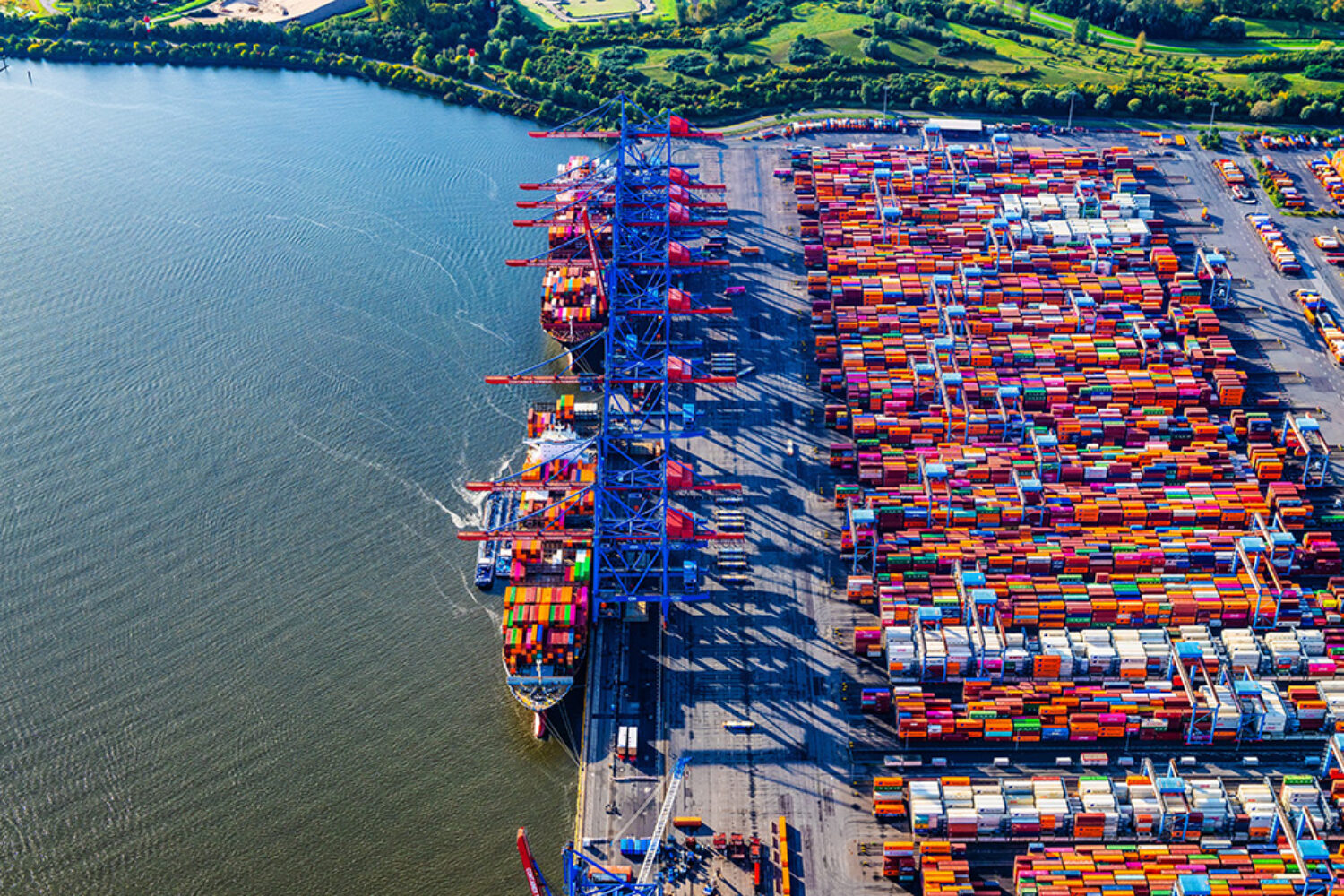

The Hamburg terminal operator HHLA has confirmed its preliminary business figures. Revenue and profit have risen sharply

Hamburger Hafen und Logistik AG (HHLA) recorded a positive earnings trend in the 2024 financial year despite global challenges. Group revenue increased by 10.5% to € 1.6 billion (previous year: € 1.44 billion). The Group operating result (EBIT) increased by 22.7% to € 134.3 million and was therefore within the expected range of € 125 million to € 145 million (previous year: € 109.4 million). Consolidated net income after minority interests rose to € 32.5 million (previous year: € 20.0 million).

In the listed Port Logistics subgroup, revenue increased by 10.8% to € 1.56 billion (previous year: € 1.4 billion). The operating result (EBIT) increased by 26.8% year-on-year to € 117.8 million (previous year: € 92.9 million). Net profit after minority interests amounted to € 23.0 million (previous year: € 8.7 million).

In addition to the strong increase in transport volumes at the Intermodal companies, the year-on-year rise in storage fees due to longer dwell times for containers handled at the Hamburg terminals had a positive impact on revenue and earnings development. Earnings per share therefore amounted to € 0.32 (previous year: € 0.12).

Container throughput at HHLA only slightly up

Container throughput at HHLA‘s seaport terminals increased only slightly year-on-year by 0.9% to just over 5.9 million TEU. At 5.7 million TEU, the handling volume at the Hamburg container terminals was on a par with the previous year (previous year: 5.68 million TEU).

While handling volumes on the routes to and from the Far East and Middle East declined, the North and South America trade lanes, in particular traffic with the United States, recorded strong growth in some cases. In addition, cargo volumes with other European deep sea ports, in particular Belgium and Greece, increased. This was mainly due to temporary route changes as a result of the military conflict in the Red Sea.

Feeder traffic volumes recorded moderate growth compared to the same period in the previous year. Container throughput within Germany and from Poland, Latvia and the United Kingdom rose particularly strongly. In contrast, cargo volumes from Finland and Denmark declined. The feeder share of waterside handling increased to 19.4% (previous year: 18.6%).

The international container terminals recorded a strong increase in handling volumes of 23.1% to 284,000 TEU (previous year: 231,000 TEU). The main drivers were the strong volume growth at the HHLA TK Estonia multifunctional terminal in Estonia and the resumption of waterside handling at the Container Terminal Odessa (CTO) in Ukraine in the third quarter of 2024. This more than compensated for declines at PLT Italy in Trieste due to ship rerouting or cancellations as a result of the military conflict in the Red Sea.

Due to the longer dwell time of the containers handled at the Hamburg terminals, which continued to make a positive contribution to storage fees, as well as the volume growth at the international container terminals, the segment’s revenue increased significantly by 9.1% to € 773.3 million (previous year: € 708.8 million). The operating result (EBIT) increased by 66.6% to € 78.7 million (previous year: € 47.2 million), mainly due to higher revenue. The EBIT margin improved by 3.5% to 10.2% (previous year: 6.7%).

In the Intermodal segment, container transportation increased by 11.6% overall to just under 1.8 million TEU (previous year: 1.6 million TEU). Rail transportation grew by 13.2% to 1.545 million TEU (previous year: 1.365 million TEU). The strong growth in the DACH region more than compensated for the decline in traffic with the Adriatic seaports and the subdued development of Polish traffic. The acquisition of a majority stake in Roland Spedition GmbH in the second quarter also contributed to growth. Road transportation recorded a slight increase of 2.2% to 242,000 TEU (previous year: 236,000 TEU).

At € 711.3 million, revenue was up 14.6% on the previous year (previous year: € 620.5 million) and therefore grew faster than the transport volume. In addition to price adjustments, the continued increase in the rail share of total HHLA intermodal transport volumes from 85.2% to 86.5% contributed to this result. The operating result (EBIT) rose by 14.8% to € 83.7 million (previous year: € 72.9 million). At 11.8%, the EBIT margin remained at the previous year’s level (previous year: 11.7%).

For the current financial year, the Port Logistics subgroup expects a strong increase in both container throughput and container transport compared to the previous year. This also applies to revenue, according to HHLA.