Like other major liner shipping companies before it, CMA CGM suffered painful losses in the past financial year.

The market environment deteriorated drastically over the course of the year. Nevertheless, the expansion and investment course embarked upon was continued, according to a statement on the annual financial statements. “In the course of the normalization of the sector, the Group delivered a solid performance,” said Rodolphe Saadé, Chairman and CEO of CMA CGM. The logistics division proved to be more robust than the shipping division. [ds_preview]

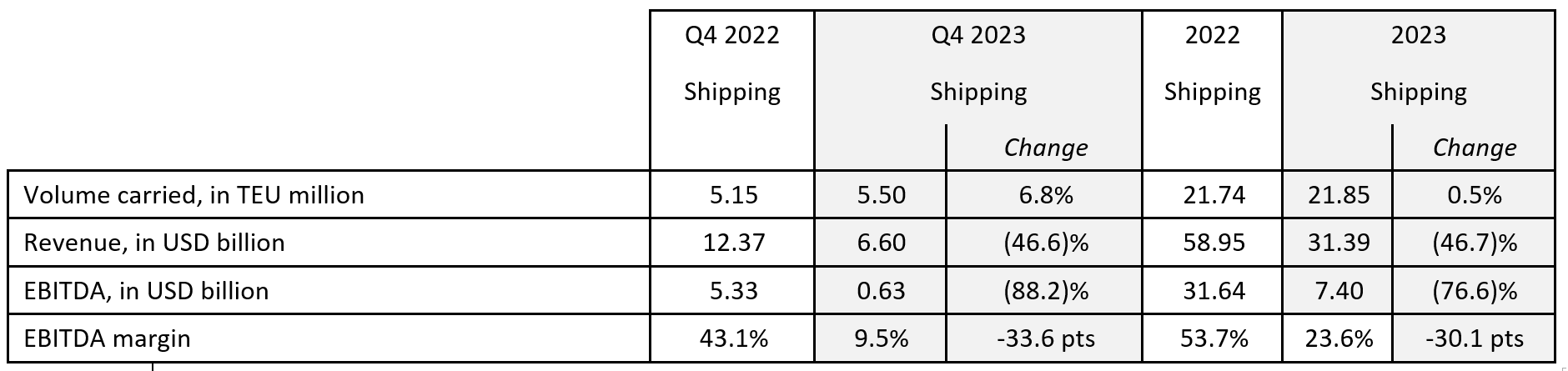

In liner shipping, the transport volume was almost unchanged (+0.5%) compared to 2022, but there were also two different half-years. In the first six months, container volumes fell sharply by 2.7% due to weak demand for consumer goods and the effects of destocking.

In the second half of the year, however, demand recovered and volumes increased by 3.8%. The volumes transported by the Group had suffered less on the North-South routes (+4.2%) and in regional traffic (+3.3%) than on East-West routes (-2.7%).

CMA CGM records slump in turnover and profit

The shipping revenue of the No. 3 in global liner shipping fell by -47% from USD 31.4 billion in the previous year to just under USD 22 billion, primarily due to the fall in freight rates. Earnings before interest, taxes, depreciation and amortization (EBITDA) fell by three quarters from USD 31.6 billion to USD 7.4 billion (-76.6%).

The picture was similar for the Group as a whole, including the logistics, port and other activities. With sales of USD 47 billion (-36.9%), this resulted in a profit of USD 9 billion (-72.9%). Despite the slowdown, the French company continued to invest in the expansion of its portfolio.

CMA CGM wants to invest further

Fleet: The shipping company is investing more than USD 15 billion in a total of 120 new ships, which will strengthen the fleet by 2027 and can be powered by LNG or methanol. Retrofits will also be carried out on existing ships. Over the past ten years, modernizations worth USD 200 million have been carried out. In addition, the shipping company La Méridionale was taken over and the RoRo business was developed.

Ports: In the United States, the company completed the USD 2.8 billion acquisition of GCT’s Bayonne and New York container terminals. In Nigeria, the Group inaugurated phase 1 of the new generation multi-user container terminal in Lekki Freeport in February 2023, bringing the number of terminals and port projects to 58.

Logistics: Following the acquisition of CEVA Logistics (2019) and Ingram Micro CLS, Colis Privé and GEFCO (2022), Bolloré Logistics was acquired last year. According to the Group, this makes it one of the world’s five leading providers of transport and logistics services.

Climate fund: The company has set up its own “Pulse” climate fund with a total of USD 1.5 billion, which is to be used to finance measures for the Group’s environmentally friendly transformation. Last year, €453 million was allocated to 40 projects. These include the production of solar modules, a battery gigafactory and the RoRo freighter “Neoline”, which is designed with an auxiliary wind propulsion system.