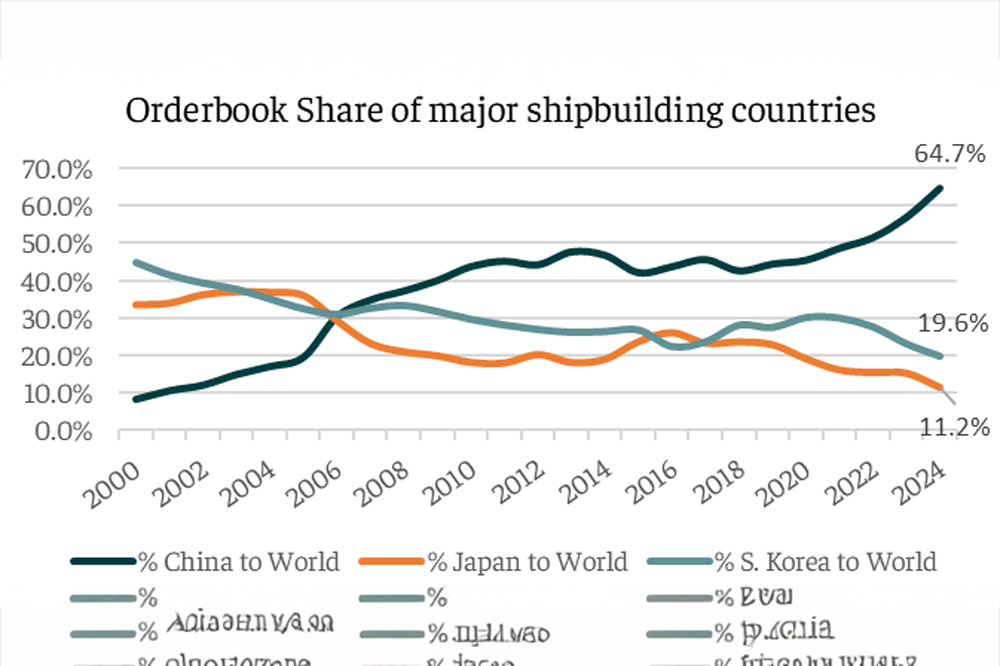

More than 5,000 ships have been ordered at shipyards worldwide. China, in particular, is benefiting from this, accounting for almost two-thirds of the order book.

The global order book has grown considerably since the Covid-19 years. Since 2021, the order backlog has increased by 41% to 5,049 ships, writes the broker Intermodal in its latest report.

Chinese shipyards have benefited the most from this demand. Thanks to government support and public investment in the national shipbuilding industry, China has significantly expanded its shipyard capacities and is the undisputed market leader with a 65% share of the global order book. In the same period, Japan and South Korea’s share fell from 78% to 31%.

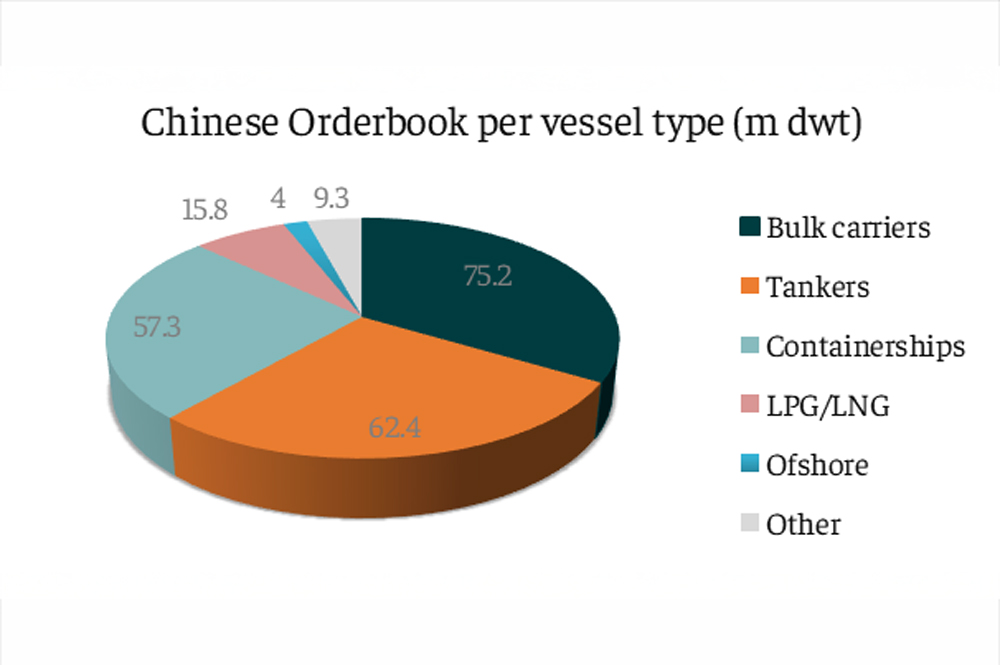

In November 2024, the Chinese shipbuilding orderbook comprised 3,256 vessels with a total carrying capacity of 224 million dwt, an increase of 37% compared to 2023 and an increase of 72% compared to 2022. In contrast, the global order backlog has only increased by 21% since 2023.

China recently reactivated a number of shipyards. These include Jiangsu Rongsheng, Hengli Heavy Industry, Yangzhou Guoyu Shipbuilding and Dalian Shipbuilding Offshore. Others such as New Times Shipbuilding, Wuhu Shipyard and Nantong Xiangyu Shipbuilding have expanded their existing capacities.

When looking at individual segments, China’s dominance becomes even clearer: 89% of orders for container ships, 81% of orders for bulkers and 74% for tankers went to shipyards in China.