The maritime energy transition requires the bunkering infrastructure in German seaports to adapt to the future demand for new fuels. Bunker ships, in particular, will be needed.

A current study by NOW GmbH examines which ship calls can be expected in Germany in the future and which technology mix scenarios are suitable for the defossilisation of the various shipping segments. This will determine the resulting supply requirements for bunker infrastructure in German seaports and inland ports. [ds_preview]

The potential study on “Refuelling infrastructures for low-carbon and renewable marine fuels in Germany”, commissioned by NOW GmbH and conducted by the management consultancy Ramboll, provides answers to these and other questions. The study provides findings and recommendations to the bunkering industry in Germany for supplying sustainable shipping traffic.

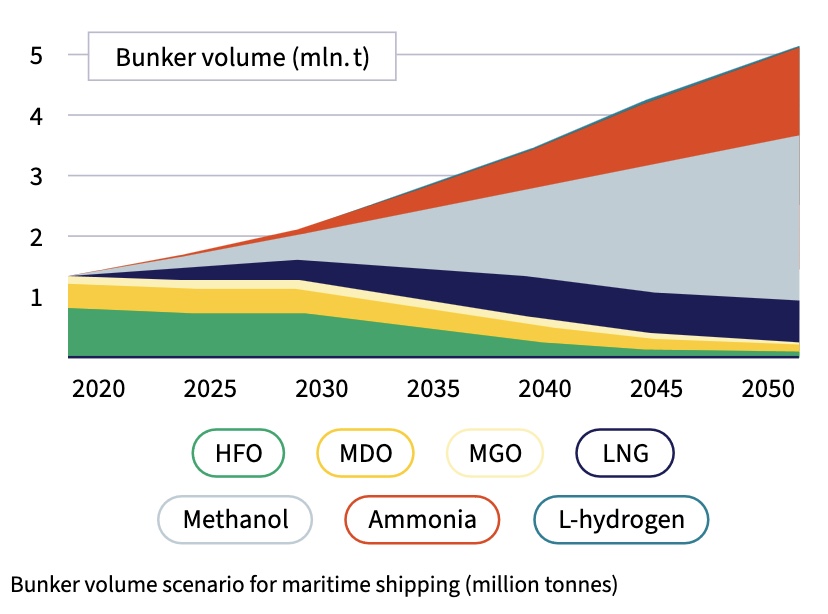

In order to achieve the climate targets, a transformation towards climate-friendly alternative drives and fuels must also take place in shipping. Bunker suppliers must adapt their bunkering structures and processes accordingly. Alternative fuels such as LNG, methanol, ammonia and hydrogen, which increasingly have to be produced from renewable sources, will play an important role in the defossilisation of shipping in the future. “Over 90% of the bunker volume in 2050 is expected to be used for these very fuels,” the study states.

It is assumed that ship-to-ship bunkering will remain the most important bunkering concept in maritime shipping in the future. In addition, many supporting bunkering operations, similar to today’s bunkering structures, will be carried out using trucks, but these will only cover small volumes.

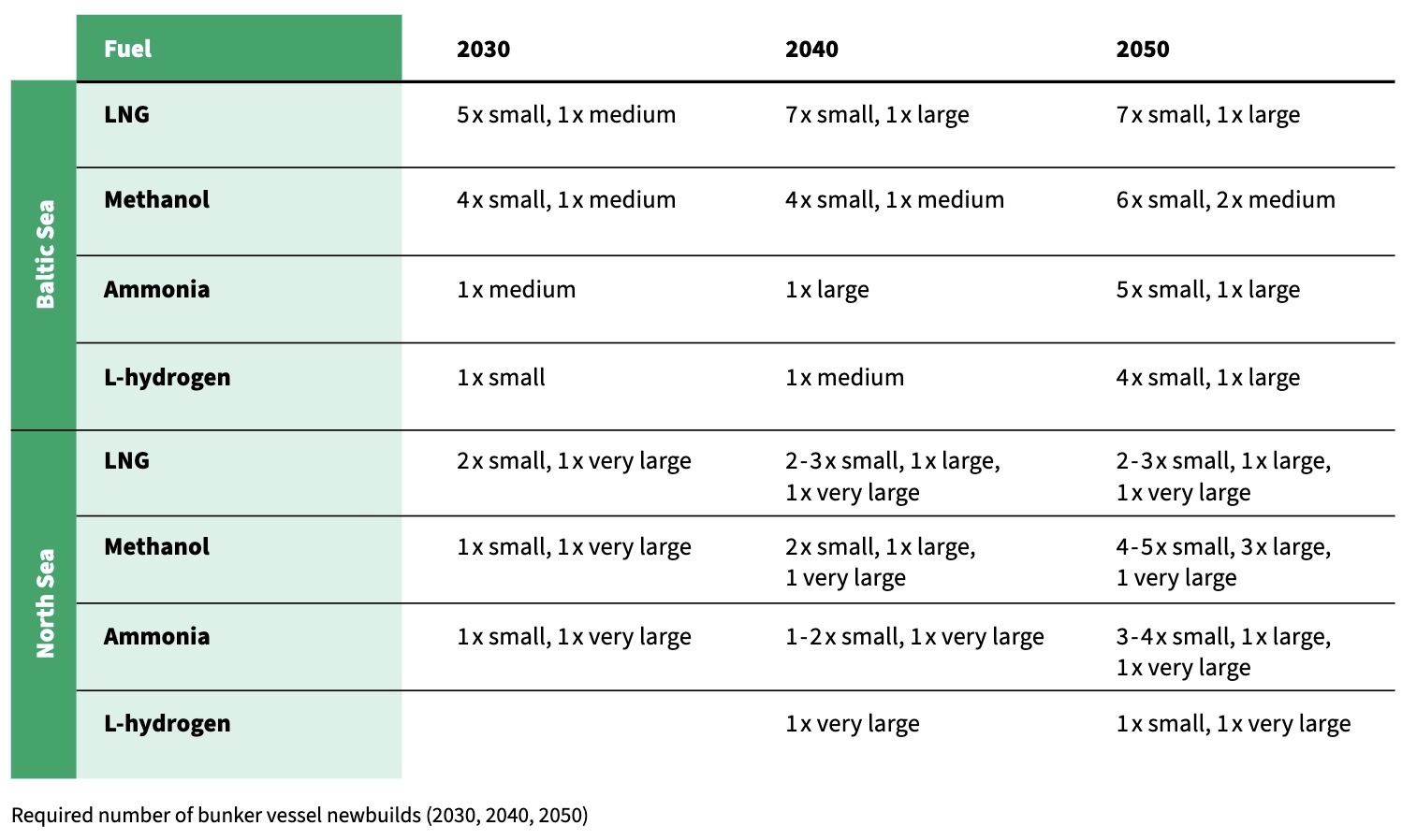

In particular, the analysis shows a need for new bunker ships: By 2050, 13 small, five large and four very large bunker vessels will be needed in the North Sea alone to supply the expected ship calls at German seaports, while 22 small, two medium and three large bunker vessels will be needed in the Baltic Sea.

A cost estimate based on indicative newbuilding prices for tankers shows a total investment volume of around €1.74bn for the construction of these ships. The calculation is essentially based on the new construction costs for tankers and bunker units in recent years plus a fixed surcharge that reflects the recent jumps in material prices and the fact that the ships are equipped as bunker ships. The additional demand for bunker fuel for inland shipping is estimated at around 100,000 tons per year in the long term. According to the study, the increase in volume depends heavily on the actual mix of bunker fuels used in inland shipping. For hydrogen and ammonia applications as well as for the use of C-/L-NG, new bunker infrastructures need to be built. For methanol in particular, expansions and rededications of existing facilities for established fuels are conceivable.

Kurt-Christoph von Knobelsdorff, NOW Managing Director and spokesperson: “The development of a robust bunker market for climate-friendly marine fuels can become an attractive service offering for German ports in international competition.”