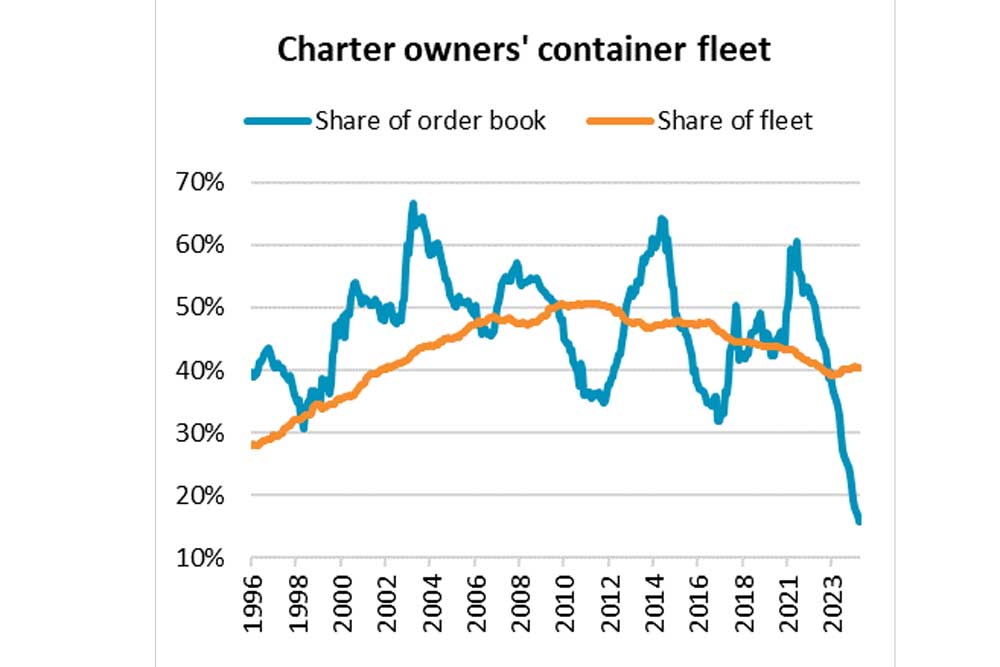

The share of tramp shipping companies in the global fleet of container ships has fallen to its lowest level since 2002. They now only account for 40% of the tonnage.

The container fleet of tramp shipping companies has increased steadily over the past twelve years, by an average of 3.2% annually. Most recently, a total capacity of 11.7 million TEU was reached. However, the fleet of liner shipping companies has grown even faster. [ds_preview]

According to a recent analysis by the shipping organisation Bimco, the share of charter ships now accounts for 40%, whereas twelve years ago it was almost exactly 50%.

According to Niels Rasmussen, Chief Shipping Analyst at Bimco, the decline has been particularly sharp in the past three years. A third of the losses have occurred since 2021. The fact that the so-called non-operating owners (NOO) have recently sold more than 600 ships with a total slot capacity of around 2 million TEU to the lines and the entire NOO fleet has shrunk to 2,550 units plays a role here.

The peak coincided with the boom in German KG financing, which contributed significantly to the growth of the tramp feeder fleet in the 2000s, it is said.

At the same time, consolidation has recently taken place: the 20 largest tonnage providers, led by Seaspan, account for around two-thirds (65%) of all charter vessels. This also includes four German owners. Chinese leasing companies, in particular, are among the new additions to the top 20.

The proportion of ships with relatively short charter terms of less than three years is also declining. This is due to a larger number of larger ships with more than 12,000 TEU, whose share is now 40% and whose employment is generally secured by the liner shipping companies before they are delivered, according to the Bimco study. Accordingly, at most 25% of the fleet’s total capacity is currently available for short-term charters on the spot market.

“In the coming years, the proportion of charter ships in the overall container fleet will continue to fall,” predicts Rasmussen. The order backlog of tramp shipping companies has fallen to just 1 million TEU, and their share of the total order backlog is now only 16%.