Cargo throughput at German seaports fell by 4.1% year-on-year in 2023, while container throughput with Chinese ports fell at an above-average rate of 12.2%.

A total of 267.8 million tons of goods were handled via German seaports in 2023, a decline of 4.1% compared to the previous year. The figures reflect the difficult geopolitical situation and the weak momentum of global trade in the past year. According to data from the Federal Statistical Office (Destatis ), German foreign trade recorded a decline in exports of goods (-2.0%) and imports of goods (-10.1%) in 2023 compared to 2022. [ds_preview]

As in the previous year, the German seaport with the highest throughput was Hamburg, with throughput of 99.6 million tons (-3.6% compared to the previous year), followed by Bremerhaven (39.2 million tons, -8.4%), Wilhelmshaven (29.8 million tons, -6.1%), and Rostock (23.9 million tons, +11.9%). Rostock benefited, in particular, from the sharp rise in crude oil handling (from 1.3 million tons in 2022 to 5.2 million tons in 2023, +300 %).

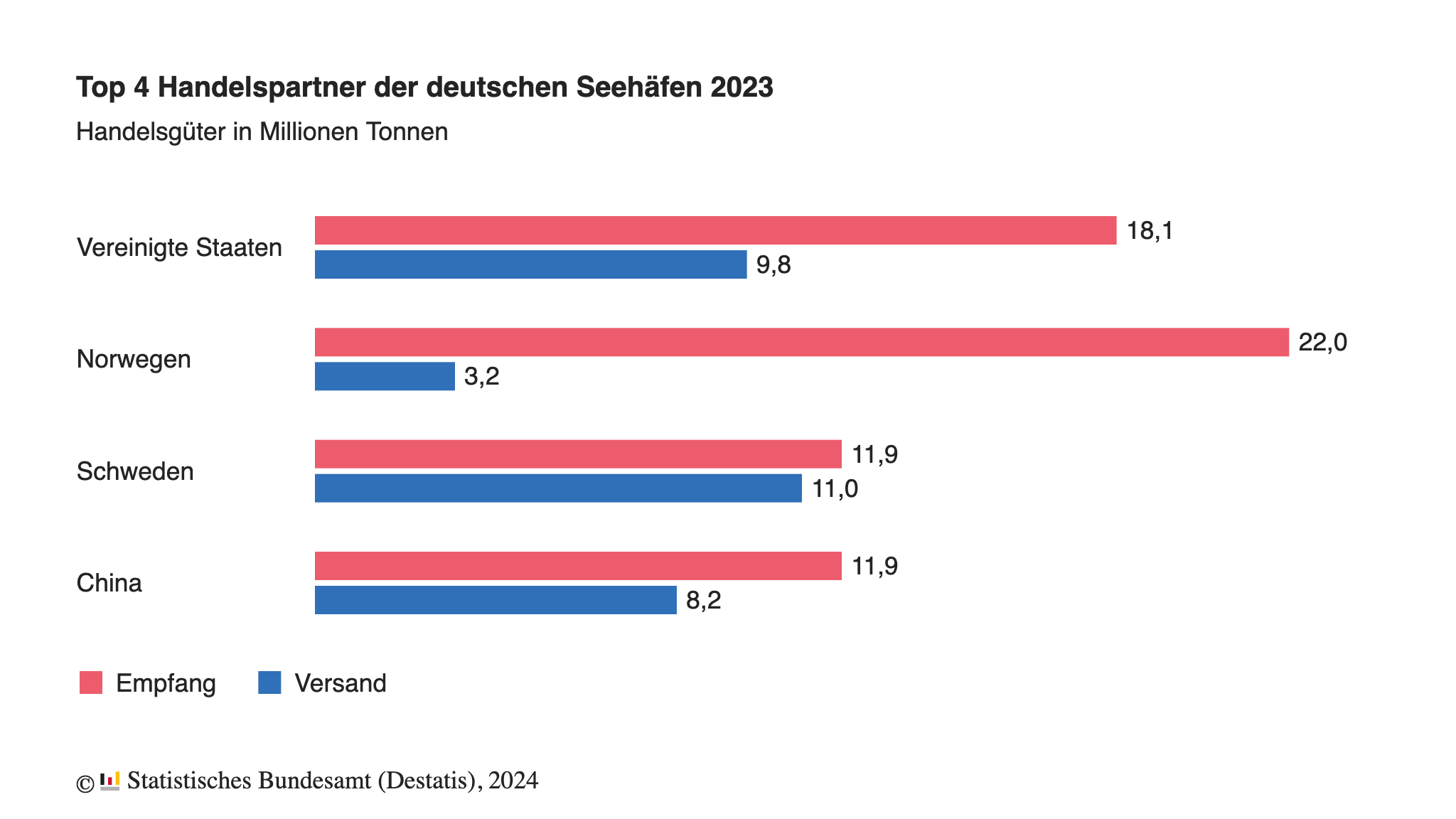

The two most important partner countries in maritime trade in 2023 were the USA (27.9 million tons of goods handled) and Norway (25.1 million tons). Sweden replaced Russia as the most important partner country in 2022 and was in third place in 2023 with 23.0 million tons of goods handled, followed by China in fourth place with 20.1 million tons. Increased deliveries of fossil fuels by the USA as a result of the Russian war of aggression against Ukraine contributed to the shifts in the ranking of the most important partner countries. More than two-fifths of goods handled in the USA (12.2 million tons) in 2023 were accounted for by the receipt of fossil fuels.

German seaports received a total of 38.0 million tons of coal, crude oil and natural gas from abroad in 2023, 5.3% more than in 2022. The receipt of coal (7.3 million tons in 2023) fell significantly (-35.9%) compared to 2022. The receipt of crude oil (25.9 million tons) increased by 6.2%, while the receipt of natural gas (primarily liquefied natural gas, LNG) multiplied from 317,000 tons in 2022 to 4.8 million tons in 2023. The USA was by far the most important natural gas supplier, with 3.7 million tons.

Container throughput in German seaports 8.5% below previous year

At 12.7 million TEU, container throughput at German seaports in 2023 was 8.5% below the previous year’s figure (13.9 million TEU). This was the second consecutive decline in container throughput. The pre-crisis level of 15.0 million TEU in 2019 has, therefore, not yet been reached again. China accounted for more than a fifth (2.6 million TEU) of German container throughput in 2023, followed by the USA with just over a tenth (1.4 million TEU). Compared to the previous year, container throughput with the ports in China fell by an above-average 12.2%, while it fell only slightly for the ports in the USA (-3.2%).

When the Federal Statistical Office compiles the handling statistics for German seaports, ships with a tonnage of at least 100 GT are recorded. This does not include fishing vessels and fish processing vessels, drilling and exploration vessels, tugs, pusher vessels, dredgers, research/survey vessels, warships and vessels used exclusively for non-commercial purposes as well as for bunkering, supply, repair and similar purposes. The data for the People’s Republic of China does not include Taiwan and Hong Kong. In maritime transport statistics, goods that are transhipped in an intermediate port during their transportation (e.g. to smaller ships) are assigned to the port in which the transhipment took place.