With tariffs of over 100%, trade relations between the USA and China are coming to a standstill.

The first signs are already visible: there are more and more empty runs in transpacific shipping – even more than at the start of the Covid-19 pandemic. The outlook for the coming weeks is bleak.

After the Trump government’s cumulative tariffs against China amounted to 145%, Beijing countered with counter-tariffs of 125%. This has effectively wiped out the sales markets for the two former trading partners in one fell swoop. The impact of this reorganization on the global economy will become clear in the coming days and weeks. However, shipping in the Pacific gives cause for concern: as the analysis company Sea-Intelligence reports, there are more and more empty runs because ships are not calling at ports as planned at short notice.

“The current political climate is extremely volatile and with tariffs being introduced and suspended on an almost daily basis, we believe that both shipping lines and cargo owners are currently only adjusting their short-term supply chains and waiting for the situation to calm down (one way or another) before making longer-term network adjustments,” said Sea-Intelligence.

Customs duties increase empty runs

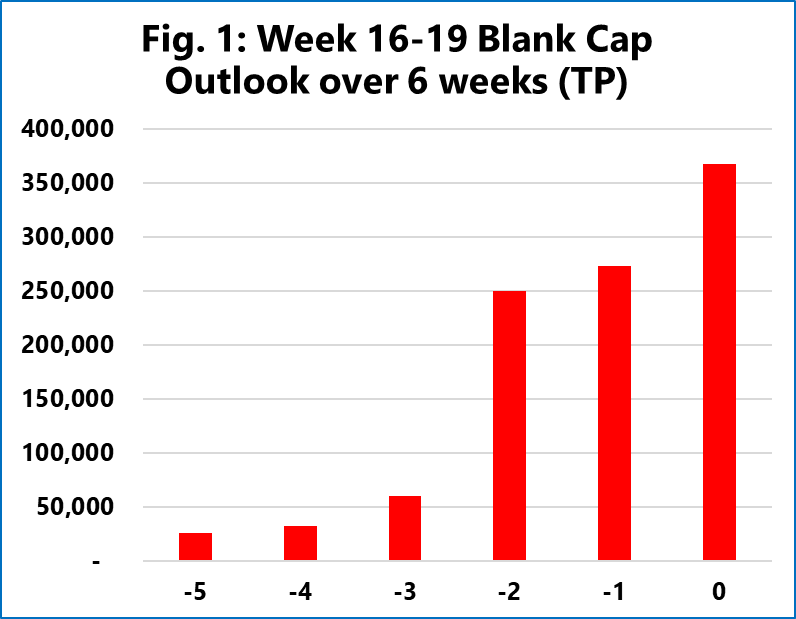

In April 2025, 80 such empty sailings were reported at US ports, a significant increase on the 51 reported in May 2020, the initial phase of the Covid-19 pandemic. The analysts looked at the four-week period from week 16 to week 19 in terms of planned capacity to estimate the impact of the tariffs. In week 10, for example, 1.43 million TEU were planned for deployment on the routes between Asia and the US West Coast for the period week 16-19. According to Sea-Intelligence, this figure remained constant in week 11 and fell only slightly to 1.40 million TEU by week 12. However, this was followed by a downturn: capacity fell rapidly in the following weeks and is now 12% below the forecast from six weeks ago.

The situation is similar on the routes between Asia and the American East Coast. Here, capacity fell from 1.01 million TEU to 867,000 TEU – a decline of 14%. Overall, the tariffs led to a sharp rise in losses: Whereas three weeks ago – as can be seen in the chart – it was “only” 60,000 TEU, it is now around 367,000 TEU.

“It is clear that the impact of the trade war has caused many shipowners to pause or cancel shipments altogether,” said Sea-Intelligence. “This in turn is reducing demand for capacity on container ships, and shipping companies are responding by canceling bookings.”

Trade war may mean the end for small shipping companies

It is to be expected that the redirection of trade flows will prove to be a challenge for shipping companies. Delays must therefore be expected in the coming weeks. The concentration of empty containers in China will also become a challenge due to the empty runs caused by the tariffs – because the capacities are urgently needed.

“The trade war is particularly destructive for smaller shipping companies,” warned Sea-Intelligence in an earlier report. “Most of them rely on large volumes from China and are not well equipped to suddenly switch to alternative cargoes of non-Chinese origin. Some of them may face complete closures of their services for the duration of the trade war.”

There are currently no comparable effects of tariffs in the Atlantic to those seen in the Pacific. Capacity here has remained largely stable, especially in light of the Trump administration’s announcement to suspend tariffs against EU countries for 90 days. (JW)