Even if some shipping companies are sending their ships through the Suez Canal again: 100 days after the last Houthi attack, the number of ship passages is still well below the level before the attacks began.

In its latest analysis, the international shipping organization Bimco – which is primarily supported by shipowners, managers and brokers – does not dare to forecast a return to “normality”. The number of Suez Canal passages is still 60% below the level of fall 2023.

100 days ago, on September 29, it was the MPP ship “Minervagracht” of the Dutch shipping company Spliethoff that was the last to be attacked by the Yemeni Houthi militia – with fatal consequences. 43 days later, the Houthis declared an end to their attacks on ships. “Despite this, shipping traffic through the Suez Canal has not increased significantly and was still 60% lower in the first week of 2026 than in the corresponding week in 2023, before ships began to sail around the Cape of Good Hope,” writes Bimco chief analyst Niels Rasmussen in a new report.

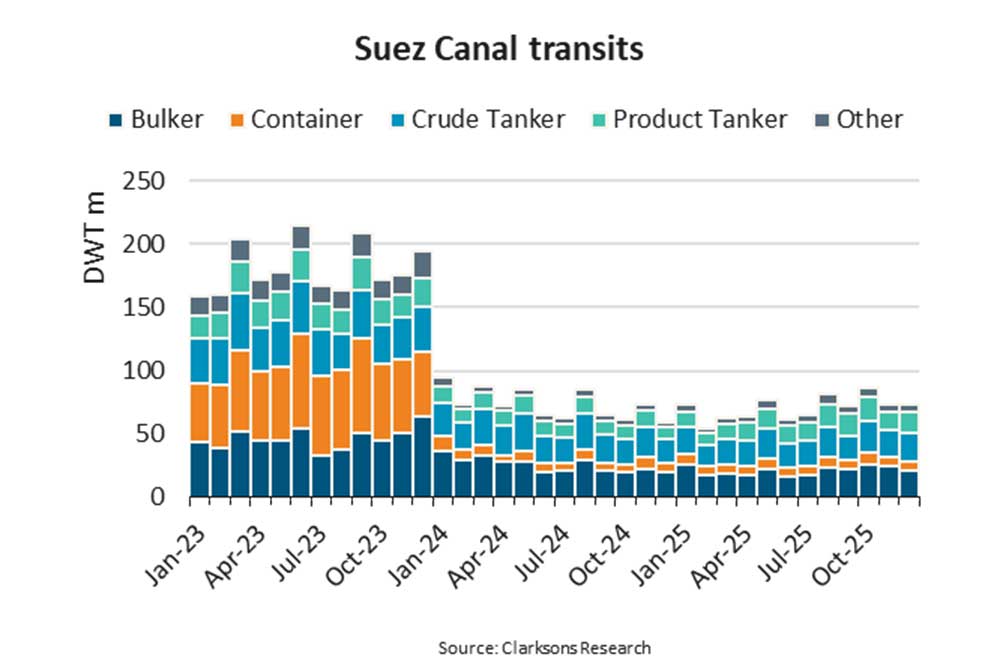

In his analysis, he refers to data from industry experts. The Houthis have attacked or captured a total of 99 ships since November 2023. Although 15 ships were attacked in November and December 2023, the number of Suez Canal transits only fell significantly from January 2024. Since then, the quarterly deadweight tonnage (DWT) of ships passing through the Suez Canal has been 51-64% lower than in 2023.

“In 2025, transits were 57-64% lower than in 2023. In the fourth quarter, the transits of bulk carriers, container ships, crude oil tankers and product tankers were 55%, 86%, 32% and 19% lower than in 2023, respectively,” said Rasmussen.

In 2025 as a whole, there was little change to the status quo in most segments. However, due to rising freight rate surcharges, product tankers finally started to use the most important waterway between Asia and Europe again. In the fourth quarter, throughput was therefore only 19% lower than in 2023, compared to a decline of 45% in 2024.

Almost all container ships have avoided the Suez Canal since the beginning of the attacks. Some shipping companies such as CMA CGM and Maersk have now found their way back into the canal or have at least announced their intention to do so. On December 19, the “Maersk Sebarok” was the first ship from the Danish shipping company to sail through the canal since the beginning of 2024. However, this should not be seen as a big go-ahead, because: “Provided that safety standards continue to be met, we are considering continuing our gradual approach to resuming shipping along the East-West Corridor via the Suez Canal and the Red Sea,” Maersk announced.

The safety of crew, ship and cargo remains a top priority for the carriers. However, the recent reductions in risk premiums for the Red Sea could encourage more ships to use the routes through the Suez Canal again, according to analysts at Bimco. In early December, S&P Global reported that premiums had fallen to 0.2% of ship value – the lowest level since November 2023 and a drop from 0.5% before the ceasefire between Israel and Hamas.

“A normalization of shipping now appears more likely than at any time in the past two years,” Rasmussen writes – but then immediately emphasizes: “Whether and how quickly this will happen, however, is still uncertain. While a return to the Suez Canal would significantly reduce shipping companies’ costs, it would at the same time affect demand for ships.” According to estimates, full normalization would reduce demand for container ships by around 10%, while other sectors are likely to see declines of 2-3%. (MM)