Seven major port operators accounted for over 40% of global throughput in 2023, according to Drewry.

While the total number of global terminal operators included in Drewry’s rankings remained unchanged at 21 in 2023, their composition has changed significantly: The rankings, which take center stage in the latest edition of Drewry’s “Global Container Terminal Operators Annual Review and Forecast”, now also include Adani, AD Ports Group and Hapag-Lloyd, while SAAM Ports and Bolloré have been removed from the rankings due to their acquisition.

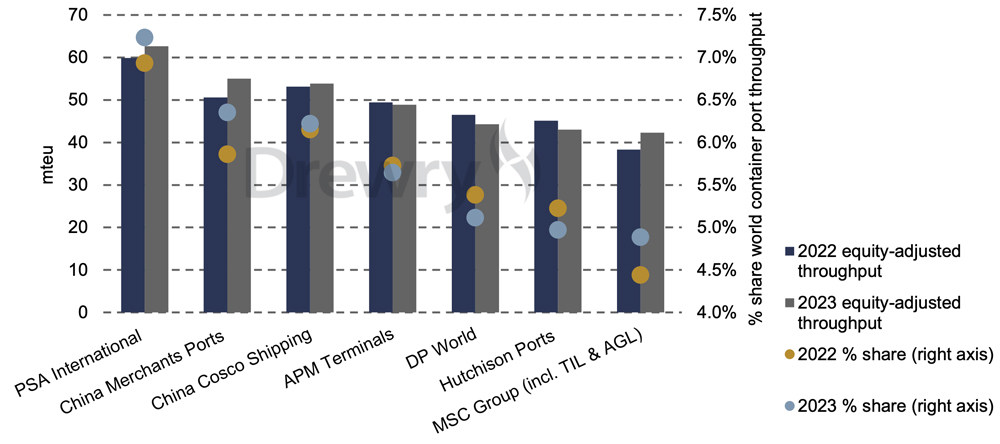

Overall, the position of the largest global terminal operators at the top of the ranking has been further consolidated, with the top seven companies now handling over 40% of global port throughput.

“The seven largest terminal operators all reported handling more than 40 million TEU in 2023,” said Eleanor Hadland, author of the report and senior ports and terminals analyst at Drewry. “While several of the smaller terminal operators have clearly indicated their intention to expand their portfolios, there are very limited opportunities to close the 30 million TEU gap that exists between this top group and the rest of the table.”

PSA maintains 1st place in the Drewry ranking

Notably, PSA International retained first place in the ranking with a throughput of 62.6 million TEU in 2023, an increase of 4.6% compared to 2022.

China Merchants moved up to second place with a throughput of 55 million TEU. The strongest growth was recorded by the MSC Group, which grew by more than 10% following the acquisition of Bolloré Africa Logistics in December 2022.

The highest ranked new entrant was Adani in 13th place with a throughput of 6.5 million TEU, a position that is expected to improve next year due to strong growth in the Indian market fueled by international developments. Similarly, Drewry expects AD Ports and Hapag-Lloyd to improve their rankings in 2024, when the impact of their 2023 acquisitions will be visible for the full year.

Annual throughput growth for the 21 terminal operators was 2.3% in 2023, significantly higher than the 0.3% increase in global port throughput. Terminal operator revenues were mixed, with the normalization of congestion-related storage revenues to pre-Covid levels reducing additional revenues from inflation-related tariff increases.

The Drewry Global Container Terminal Revenue Index saw an upward trend in global container terminal revenue in the final quarter of the year, driven by robust demand from the US, with positive momentum accelerating in the first quarter of 2024 due to the impact of the Red Sea crisis, which in turn increased congestion-related storage revenue.

“While congestion is gradually easing, the recovery in consumer demand in import-dominated markets will continue to support the average revenues reported by the terminal operators included in the index,” Hadland added.