Prices for second-hand containerships are rising by double-digit percentages despite lower freight rates. According to the shipping association Bimco, the strongest increase has been recorded in the feeder segment.

In a market analysis published recently, the organization, which is mainly supported by shipowners and ship managers, focuses on the discrepancy between freight rates and the prices of used ships. The result: “Despite significantly weaker freight rates, the average price for five-year-old container ships has risen by 17% compared to the previous year and by 6% since the beginning of 2025,” says chief analyst Niels Rasmussen.

The average price per TEU – based on a group of seven five-year-old container ships – was $9,761 at the end of August 2024. Since then, the price has risen to $10,758/TEU at the beginning of the year and to $11,413/TEU at the end of August. That is an increase of 17% year-on-year and 6% since the beginning of the year. Strikingly, feeder ships with a capacity of less than 3,000 TEU recorded the highest price increase, averaging 26% year-on-year.

Shipowners are earning well

Rising second-hand prices are often a consequence of high freight rates. If shipowners are earning well, this is often due to high demand for tonnage. Used tonnage is sought after accordingly – and the price rises. However, the current situation is very different: According to the Shanghai Shipping Exchange, spot freight rates for containers from Shanghai have fallen by 51% since the end of August 2024 and by 42% since the beginning of 2025. Average freight rates for Chinese exports have also fallen by 41% year-on-year and by 25% since the beginning of the year. Global average freight rates have improved, according to Rasmussen, but are still declining as market volumes have failed to keep pace with average fleet growth of 8.7% year-on-year.

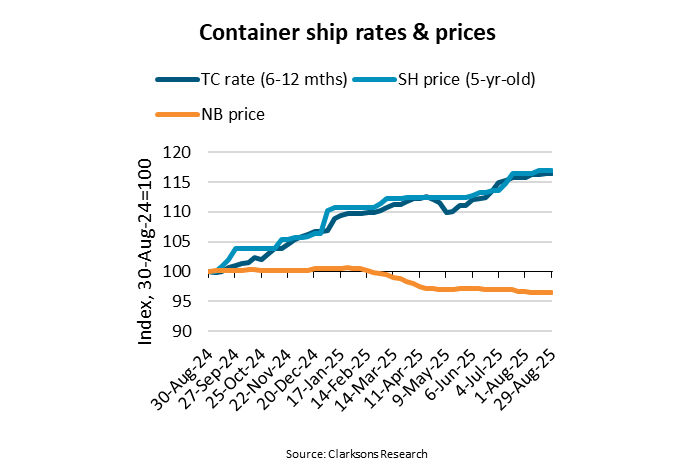

However, Bimco does provide a possible explanation for the price jump: while freight rates have not supported the price of used ships, this has certainly been the case for time charter rates: “Like prices for five-year-old ships, time charter rates for a period of 6 to 12 months have risen by 17% year-on-year and by 9% since the beginning of the year.”

Newbuilding prices have fallen

In his analysis, Rasmussen also refers to the industry service Alphaliner, according to which rates and prices have decoupled from each other, as the proportion of unused ship capacity in 2025 has remained below 1%.

Meanwhile, newbuilding prices have fallen by 4% both year-on-year and since the beginning of the year. The average price for five-year-old ships has risen to 80% of the average newbuilding price, which is the highest relative price since the end of 2022, according to the report.

Looking ahead, the delivery of ships with a total capacity of 2.3 million TEU is planned for 2025 and 2026. “Although there is still great uncertainty in the trade, it is unlikely that container volumes will grow as fast as the fleet. Under normal circumstances, we would expect both time charter rates and prices for second-hand vessels to start falling at some point. However, rates and prices for feeder vessels with a capacity of less than 3,000 TEU could prove to be quite stable, as vessels scheduled for delivery before the end of 2026 will only increase the total capacity of this segment by 2.7%,” says Rasmussen.