The French shipping and logistics group CMA CGM recorded a significant decline in its results in the third quarter of the current year.

The company achieved a net profit of $749 million – a drop of 72.6% compared to the same period last year. Sales amounted to $14.0 billion, which corresponds to a decline of 11.3%. The Marseille-based group attributes this to an extremely volatile global environment, characterized by geopolitical tensions and ongoing disruptions to key trade routes. Despite the difficult conditions, the Group reports a solid performance overall and is continuing its international growth strategy.

EBITDA plummets in the third quarter

Earnings before interest, taxes, depreciation and amortization (EBITDA) slumped by 40.5% to around $3 billion, while the margin of 21.0% was 10.3% below the previous year’s figure. The Group attributes this development to geopolitical conditions and trade tensions.

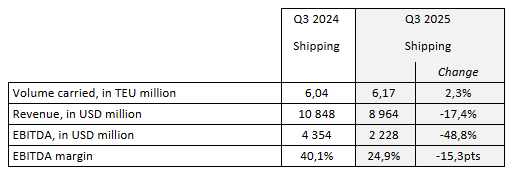

The volume transported reached 6.2 million TEU, up 2.3% on the same period of the previous year. Consolidated revenue from the maritime transportation business, on the other hand, fell by 17.4% to around $9 billion. EBITDA fell to $2.2 billion (-48.8%), while the margin decreased by 15.3 percentage points to 24.9%.

CMA-CGM CEO continues to expect “weakened demand”

“In a global environment that remains extremely uncertain, our Group continues to demonstrate resilience and discipline. Shipping is developing solidly, our terminals are gaining momentum and air freight remains strong. Together with logistics, this underlines the increasing complementarity of our activities,” emphasized Rodolphe Saadé, Chairman and CEO of the CMA CGM Group.

Mr. Saadé went on to say that in the coming months, the industry is expected to see increasing capacity and weakening demand. CMA CGM will continue to adapt, guided by its long-term focus and commitment to serve its customers in the best possible way.

Revenues from other activities, which include port terminals and CMA CGM Air Cargo, increased by 55% to $1.2 billion due to the integration of terminal operator Santos Brasil. EBITDA reached 299 million dollars.

French take a stake in Eurogate

CMA CGM recently announced its intention to acquire a 20% stake in Eurogate Container Terminal Hamburg (CTH). The plan is to modernize and increase capacity from 4 million TEU to 6 million TEU.

CMA CGM, the third largest liner shipping company in the world in terms of capacity, is not only active in shipping itself, but also in the operation of ports, logistics and air freight. Among other things, it was announced in the fall that the company had invested in the British rail freight service provider Freightliner.

According to the latest data from Alphaliner, the CMA-CGM Group ranks third among the world’s largest container shipping companies with a slot capacity of 4.08 million TEU and a total of 706 ships. The Group operates 347 of its own ships with a total of 2.51 million TEU, while 359 units with 1.57 million TEU are chartered. The charter share is therefore 38.5%. The expansion of the fleet is strikingly strong: The order book comprises 128 ships with a total of 1.71 million TEU – around 42% of existing capacity.