Rolls-Royce’s Power Systems division, known for its mtu products and solutions, has reported significant growth in the first half of 2025.

Adjusted for the sale of its lower power engine business in 2024, revenue rose by 20% to EUR 2.4 billion (GBP 2.0 billion), while adjusted operating profit surged by 89% to EUR 371 million (GBP 313 million).

Strong demand in the energy sector, particularly for data centre power systems, as well as continued momentum in governmental business, drove performance across all key financial metrics. Among the standout achievements of the first half were the largest order to date for a battery energy storage system (BESS) from a Lithuanian energy provider, and an extended framework agreement with Italian yacht builder Sanlorenzo for mtu propulsion, exhaust aftertreatment, and automation systems.

Strategic investments in future technologies and global production

CEO Joerg Stratmann attributed the company’s strong performance to strategic focus, innovation, and customer trust. “We are growing profitably and faster than the market – in a challenging global environment,” he said. “At the same time, we are investing more than ever before in new engine platforms, future technologies, and plant expansion.”

The company’s global workforce continues to grow, with open positions across German sites such as Friedrichshafen, Magdeburg, Augsburg, and Ruhstorf, as well as in Aiken and Mankato in the United States. Rolls-Royce Power Systems is investing approximately USD 100 million in expanding both US plants.

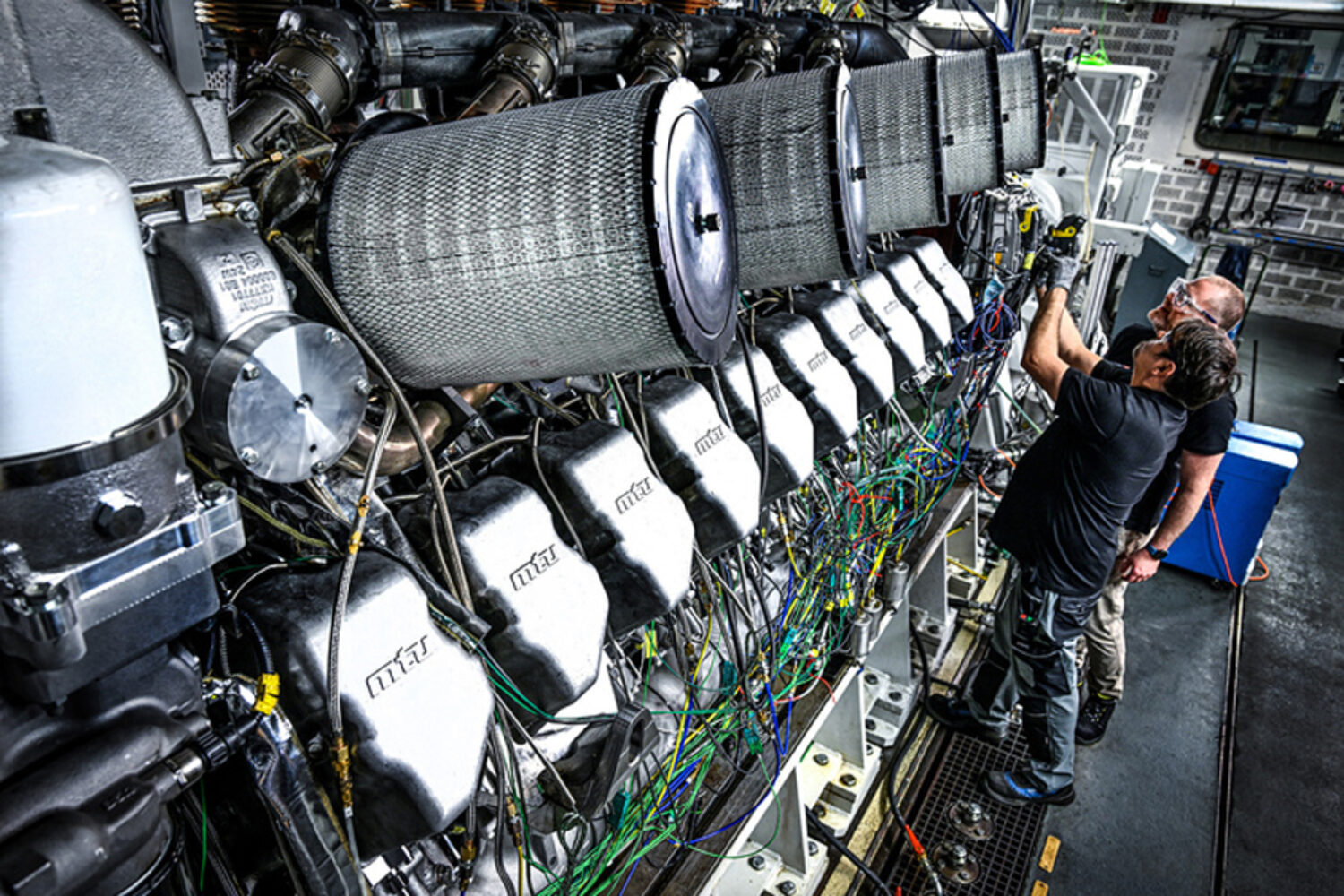

The mtu Series 4000 assembly line in Friedrichshafen will go into operation in mid-2026 as part of a broader production modernization effort. Meanwhile, the first China-built mtu 4000 series engine for the oil and gas sector recently rolled off the line at the MTU Yuchai Power joint venture, and the first next-generation mtu 2000 series engine was completed in Suzhou.

Record order backlog and robust cash flow fuel future growth

The company’s order backlog has reached record levels, with full OE order coverage for the rest of 2025 and 43% coverage for 2026. Order intake reached EUR 3.5 billion (GBP 2.9 billion), a 32% increase year-on-year, driven largely by a 68% surge in power generation demand. The book-to-bill ratio stood at 1.4x.

Trading cash flow rose sharply to EUR 505 million (GBP 425 million), up from EUR 142 million (GBP 121 million), thanks to higher operating profit and improved working capital performance. The company is using its increased liquidity to further invest in profitable growth, especially in the energy, defense, large yacht, commercial marine, and battery storage sectors.

Rolls-Royce is also developing a new mtu engine platform, with improved power density, lower emissions, and better fuel efficiency, scheduled to enter the market in 2028. Additionally, mtu engines for military land vehicles are being upgraded to meet higher performance demands.