Port fees between the USA and China are to be suspended, and no new tariffs will be introduced for the time being. Nevertheless, the market is not expected to ease in 2026.

After renewed escalation in the trade dispute between the two economic powers, which led to high tariffs and reciprocal port charges, both sides have now relented. For the next twelve months, no new tariffs will be imposed, and the previously excessive port fees have been suspended.

Container market already hit hard

However, the damage to the container market has already been done. According to an analysis by industry intelligence firm Xeneta, freight rates are expected to continue falling in 2026.

Average spot rates from China to the US West Coast stood at $2,147 per FEU on October 31 – down 59% year on year. From China to the US East Coast, rates were $3,044 per FEU, a 48% decrease. The falling rates coincide with declining transpacific volumes: in August, demand for container shipments from China to the US dropped by 13% compared to the previous year.

Xeneta: “No sudden boost in demand”

“The agreement between the US and China is a positive development, but it will not provide a sudden boost to the flagging demand for ocean freight containers in the transpacific trade,” said Emily Stausbøll, Senior Shipping Analyst at Xeneta. “Tariffs remain high, and US shippers will use the first half of 2026 to reduce inventories built up earlier this year in anticipation of the escalating trade war.”

Xeneta expects global average spot rates for 2026 to fall by up to 25%, with long-term freight rates declining by around 10% amid subdued demand between the world’s two largest trading nations. Overall, global freight rates are forecast to average 20% below December 2023 levels – before the Red Sea crisis escalated.

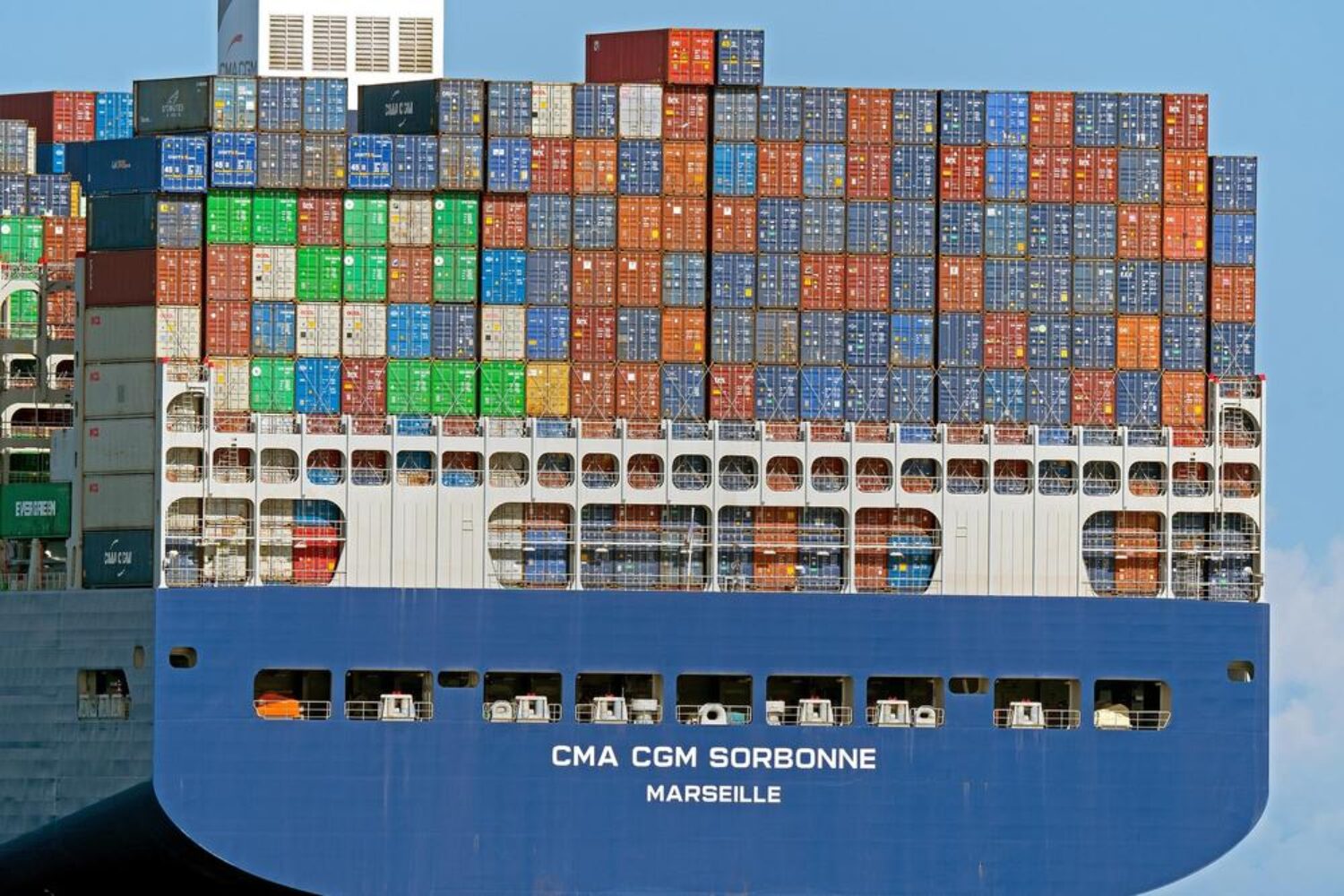

“Massive oversupply” expected in 2026

“The US-Chinese agreement provides for the elimination of port charges for ships calling at ports on both sides of the Pacific,” Stausbøll added. While this is “welcome news” for carriers burdened with multimillion-dollar port fees, many are still facing the prospect of loss-making operations if contract rates drop significantly below pre-crisis levels.

“There will be a massive oversupply of container ships in 2026,” she warned. “Shipping companies will struggle to deploy their fleets efficiently on the major China–US routes, as the lower tariffs announced this week are unlikely to bring much relief.”

Temporary deal leaves long-term uncertainty

Long-term stability remains uncertain. Without a lasting trade agreement, both carriers and shippers face an unpredictable future.

“Once again, we see trade being used as a weapon in geopolitical conflicts,” Stausbøll said. “The port tariffs set by the US Trade Representative have been suspended without progress on the real goal – strengthening US shipbuilding. Carriers have already repositioned vessels to mitigate the impact of the tariffs, measures that now appear in vain. This temporary and vague deal leaves shippers unable to plan long-term supply chain decisions – it takes longer than twelve months to relocate production out of China.”

ICS welcomes tariff suspension

From the perspective of the International Chamber of Shipping (ICS), the suspension of port charges is nevertheless a positive signal. “Reports of the US decision to suspend Section 301 port charges for one year, and China’s reciprocal move to halt countermeasures on US-bound vessels, are a welcome and positive development,” the ICS stated.

The organisation noted that such tariffs do not support the goal of strengthening US shipbuilding capacity or improving global competitiveness. “The port charges imposed by the USTR on October 14, 2025, and China’s countermeasures have already caused significant disruptions to global trade,” ICS said. “We remain committed to ensuring the unimpeded and efficient movement of goods and continue to work with all governments and international partners to prevent further disruptions.”