The Helsinki-based research institute Centre for Research on Energy and Clean Air (CREA) publishes a monthly analysis of Russian fuel exports and sanctions. According to this, it is not only the tankers of the shadow fleets that are involved in the transportation of Russian oil.

The institute examines the routes by which oil exports and other fossil fuels leave Russia and who the buyers are. EUR 1.1 billion flowed into Russia for the import of fossil fuels from the .

According to CREA, more than half of Russia’s oil exports in July 2025 were carried by tankers from the G7+ region. Tankers from the “shadow” fleets continue to dominate crude oil exports.

According to the institute, Russia’s monthly revenues from fossil fuel exports fell by 3 % compared to the previous month to EUR 585 million per day. In the same period, however, revenues from pipeline gas rose by 41% to EUR 71 million per day, with a 33% increase in volume month-on-month. The 41% increase in exports via the TurkStream pipeline follows a maintenance interruption in June and could also be due to heatwaves, which increased electricity consumption and gas-based power generation, CREA said.

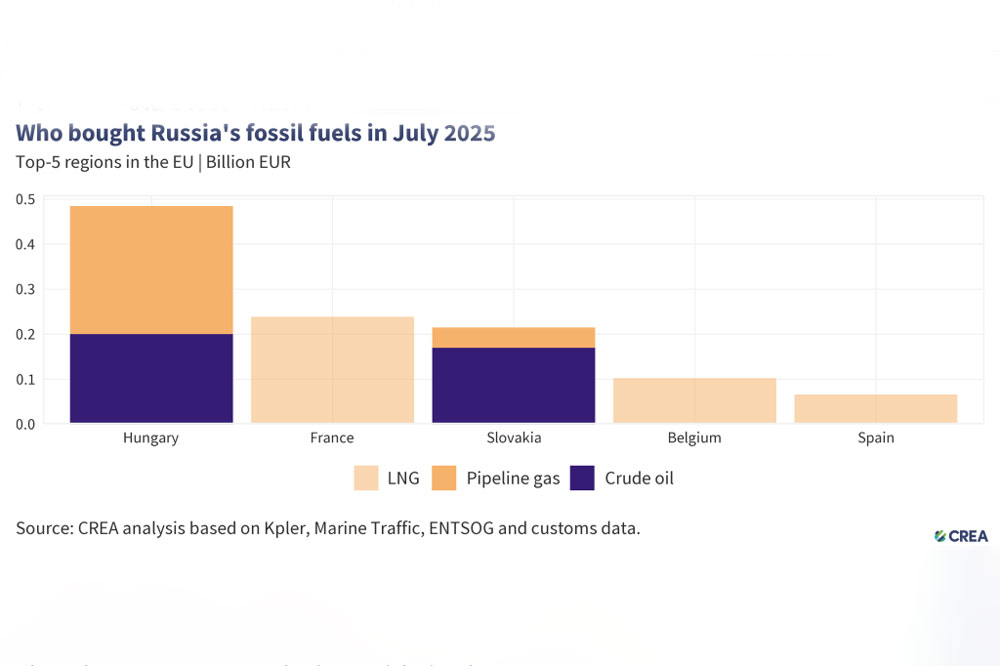

The five largest EU importers of Russian fossil fuels – Hungary, France, Slovakia, Belgium and Spain – paid Russia a total of EUR 1.1 billion for these imports. Natural gas, which is not sanctioned in the EU, accounted for over 67% of imports. In July, this was mainly delivered by pipeline or as liquefied natural gas.

G7+ share of Russian oil transportation increases

Russia exported 25.3 million tons of oil by ship in July. Over half (55%) of these exports were transported on tankers owned or insured by companies from the G7+ region – a decrease of 2 percentage points compared to June. Since January, the G7+ share of Russian oil transportation has risen from 36% to 55%.

A lower price cap of USD 30 per barrel would have reduced Russia’s revenues from oil exports by 40 % (EUR 150 bn) by the end of June 2025 since the EU sanctions came into force in December 2022. In July alone, a price cap of USD 30 per barrel would have reduced Russian revenues by 36% (EUR 3.84 billion), according to CREA.

Since the introduction of sanctions until the end of June 2025, consistent enforcement of the price cap would have reduced Russia’s export revenues by 11%. In July 2025 alone, this would have led to a 6% drop in revenue, the institute reports.

The Centre for Research on Energy and Clean Air (CREA) is a research institute that specializes in analyzing the effects of energy production, air pollution and climate policy. According to its own information, it collects and evaluates data on emissions, energy exports and political measures in order to provide governments, the media and the public with scientifically sound information. The aim is to improve air quality, combat climate change and reduce dependence on fossil fuels.