While the order books in container shipping are at an all-time high, demand in the bulker segment has recently fallen. Analysts see several reasons for this.

Global shipbuilding is booming: the order books of many shipping companies are full and numerous shipyards are working to capacity until the 2030s. The biggest beneficiary of this development is China, which has been the world’s most important shipbuilding nation for years. However, while container shipping companies are ordering more and more tonnage, the proportion of bulkers has recently declined, as new data from the shipping organization Bimco shows.

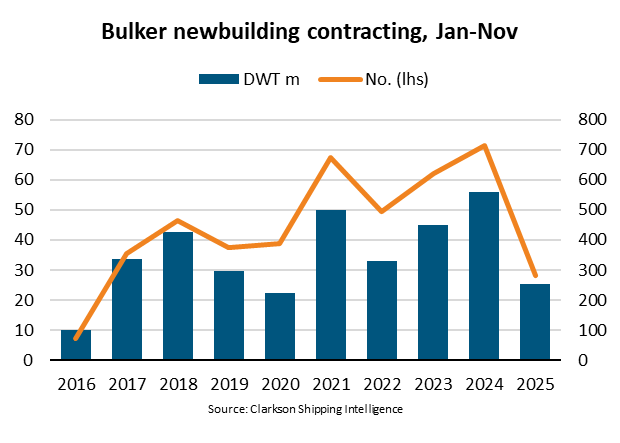

“Between January and November 2025, the capacity for newbuildings of bulkers fell by 54% year-on-year to 25 million dwt, the lowest level since 2020,” says Filipe Gouveia, Shipping Analysis Manager. “As a result, the order book for dry bulk carriers is now 4% smaller than a year ago and accounts for only 11% of the dry bulk fleet. Order placement is likely to have slowed due to the bleak market outlook.”

The number of vessels on order has fallen even more sharply than tonnage, dropping 61% year-on-year so far in 2025. Only 281 ships have been ordered so far – the lowest number since 2016. While orders have fallen in all bulk segments, orders in the Capesize segment, which includes the largest ships, have been comparatively higher.

The outlook for freight rates over the next two years appears to be best for the Capesize segment, according to Bimco. Growth in freight demand could slow down, but routes are likely to increase. In addition, supply growth is estimated to be low due to limited deliveries. Capesize vessels have the longest delivery times: 77% of the contracts signed so far this year are not expected to be delivered until after 2027.

“Incoming orders in the Supramax and Panamax segments have fallen significantly, by 76% and 55% respectively compared to the previous year,” explained Gouveia. “Both segments have comparatively large order books, which is why ship deliveries are expected to increase in 2026 and 2027. In addition, the demand forecast appears weak and a possible return of ships to the Red Sea poses an additional downside risk to demand in these segments. These factors could lead to lower freight rates over the next two years, which could inhibit the awarding of newbuilding orders.”

Four out of five ships are built in China

China remains the “top dog” in shipbuilding: 81% of new orders in terms of ship capacity went to Chinese shipyards, an increase of 9% compared to the previous year. In contrast, Japan, the world’s number three, lost further market share.

“China will thus remain by far the dominant shipbuilding nation in the bulk sector in 2025, despite the previously announced and now suspended USTR port fees for ships built in China,” Bimco reported. “Shipments to or from the US account for only 8% of global cargo volumes, which – along with several fee exemptions – has likely contributed to the continued preference for Chinese yards.”

One factor favoring newbuilding orders is a 3% drop in prices since the beginning of 2025, compared to a 4% increase in the price of five-year-old second-hand vessels. Currently, a five-year-old second-hand vessel sells on average for 93% of the price of a newbuild. This reflects an improvement in market conditions and freight rates in the second half of the year, according to Bimco. Although lower prices could theoretically encourage order placement, delivery times for new orders remain high. As a result, ships ordered today could be delivered under completely different market conditions.

“The proportion of contracted capacity designed for the use of alternative fuels has fallen by 2025,” says Gouveia. “However, the proportion earmarked for future retrofitting has increased. This could indicate ongoing uncertainties regarding the availability of alternative fuels. In total, 12% of the equipment currently on order could run on alternative fuels when delivered, of which 48% could run on methanol, 37% on LNG and the rest on ammonia.”