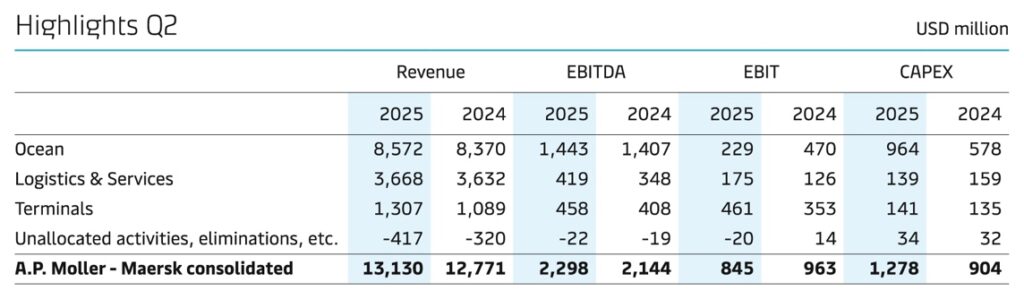

The Danish shipping and logistics group A.P. Moller – Maersk closed the first half of 2025 with a solid result. Revenue in the second quarter rose by 2.8% year-on-year to around USD 12.95 billion, while the operating result (EBIT) amounted to USD 845 million.

This results in EBIT of around USD 2.06 billion for the first half of the year. Despite geopolitical uncertainties and volatile freight rates, the company was able to maintain its overall profitability.

According to Maersk, the most important growth factors were the Ocean division, the stable development in the Terminals and Logistics & Services segments, volume-related growth in container shipping (Ocean) and strict cost discipline in all divisions.

“Strong first half-year”

CEO Vincent Clerc spoke of a “strong first half-year”, driven by operational improvements and the successful launch of the “Gemini” cooperation with Hapag-Lloyd. The new East-West service structure, which has been fully implemented since June, has noticeably increased reliability and supported volumes in the Ocean segment.

“Even in a volatile market environment with historically high uncertainty in global trade, demand remains stable. We are responding quickly and flexibly to support our customers with the resilience of their supply chains,” says Clerc.

Ocean segment: higher volumes, but continued price pressure

In the Ocean segment, the volume transported increased by 4.2% year-on-year, primarily thanks to exports from Asia. Although freight rates recovered slightly over the course of the quarter, they remained below the previous year’s level. The operational focus was on stabilizing the network and implementing the Gemini services, which according to Maersk have already achieved a reliability rate of over 90%.

Logistics and Terminals continue to grow

Logistics & Services achieved an EBIT of $175 million – an increase of 39% compared to the previous year. The EBIT margin climbed to 4.8 % (previous year: 3.5 %). Cost discipline and productivity increases were the main drivers.

The Terminal division also grew significantly: volumes increased by 9.9%, supported by higher growth in the Ocean segment. EBIT rose by 31 % to USD 461 million, while ROIC increased from 12.2 % to 15.4 %.

Raised forecast for 2025

Based on performancein the first half of the year, Maersk is raising its forecast for 2025. The expected global container growth is now estimated at 2 to 4% (previously: -1 to 4%). The financial targets have also been adjusted. The company continues to expect the disruptions in the Red Sea for the entire year. In the second quarter, Maersk distributed a total of $864 million to its shareholders. Of this, $514 million was attributable to share buybacks.

The topic of container shipping will also be discussed extensively at this year’s HANSA Forum.

Register herenow and secure our “early bird” offers: HANSA Forum 2025