A.P. Møller-Maersk reports a 65% increase in profit to $6.5 billion for 2024 and the third best year in the company’s history.

The results were driven by higher container demand and freight rates in ocean transportation, revenue and volume growth at the terminals and solid improvements in most logistics and service products, the Danish shipping group announced.

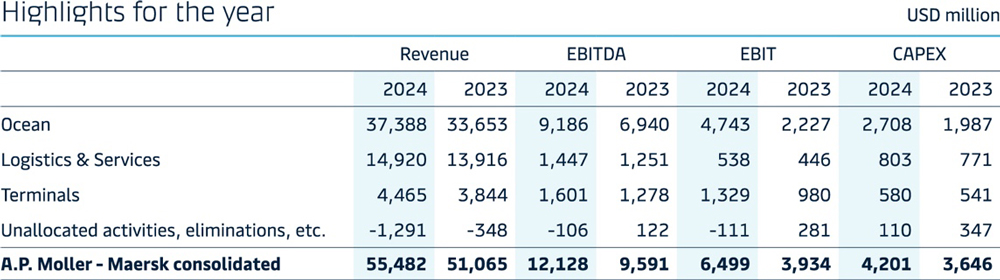

Consolidated earnings (EBIT) increased from $3.9 billion to $6.5 billion, while revenue climbed by $4.3 billion to $55.5 billion. In view of the strong results and solid balance sheet, the Board of Directors is proposing a dividend of DKK 1,120 per share and has also announced the launch of a share buyback program worth up to around $2 billion over a period of twelve months.

“We have successfully benefited from increased demand while at the same time increasing productivity and rigorously managing costs,” says CEO Vincent Clerc.

In liner shipping (“Ocean”), the No. 2 has improved profitability based on high freight rates. Profit here more than doubled year-on-year to USD 4.7 billion (2023: USD 2.2 billion). Revenue rose from USD 33.6 billion to USD 37.4 billion.

The good earnings were due to the situation in the Red Sea and the strong volume demand. Operating costs remained stable compared to the previous year and compensated for the increased costs and additional bunker consumption due to the rerouting of ships around the Cape of Good Hope.

Logistics & Services proved resilient in 2024, reporting volume growth, higher revenue and an improved EBIT margin compared to the previous year. Revenue increased by 7%, supported by solid growth in the Warehousing, Air and First Mile product categories.

The terminals achieved their best ever financial result in 2024, with EBITDA and EBIT reaching record levels. This was driven by significant revenue growth due to strong volumes combined with inflation-compensating tariff increases, an improved customer and product mix and higher warehousing income.

The outlook is characterized by great uncertainty. Global container volumes are expected to grow by around 4% in 2025, and Maersk with them. However, much depends on how the Red Sea continues to develop.

If the route through the Suez Canal is used again, the shipping company expects a sharp drop in rates and therefore profits. If this happens from the middle of the year, the break-even point should just be reached. If, on the other hand, this happens at the end of the year, the profit could be around USD 3 billion, according to reports.