According to the Kiel Institute for the World Economy (IFW), the current trade war between the US and China is likely to have a particularly severe impact on the US economy.

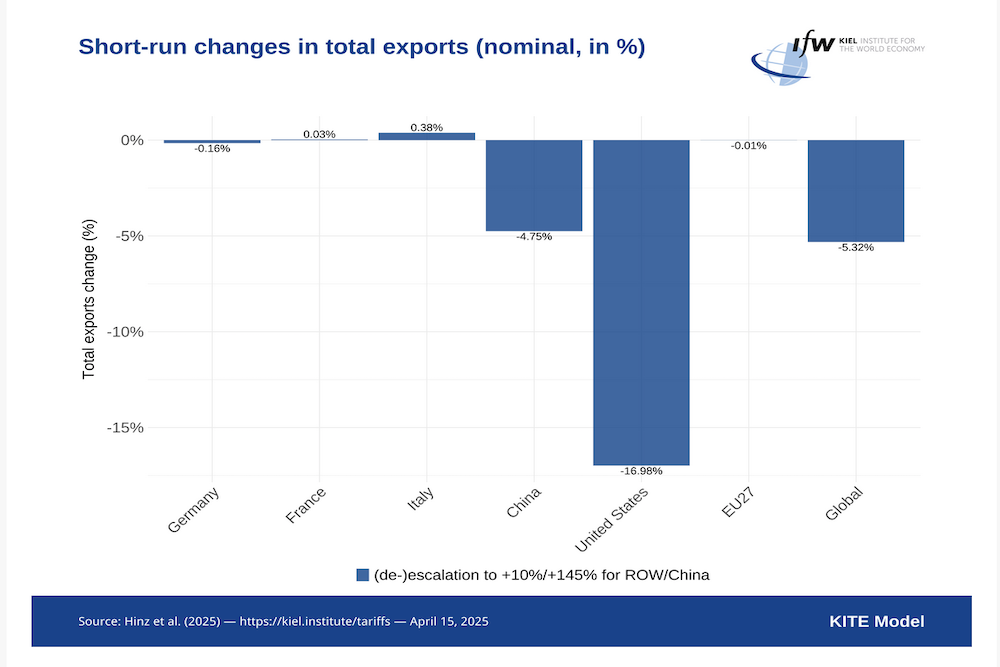

Inflation is likely to rise by over 5% and exports are likely to slump by almost 17%. The consequences for China itself are also considerable, but much less severe. Germany and the EU are hardly affected negatively.

Additional competition on the global market threatens China’s Asian neighbors in particular and for products such as Christmas decorations, dried fish and electric blankets. This is shown by simulations using the KITE model of the Kiel Institute for the World Economy.

The simulation calculations (“The consequences of the Trump trade war for Europe”) are based on the current US tariff regime of 145% on all Chinese imports, the counter-tariffs of 125% imposed by China on US imports and an additional general tariff of 10% on almost all US imports. The result would be a slump in trade between the US and China of almost 50% within a year; in the longer term, a decline of more than 70% is even conceivable.

Rising prices for US consumers

In the short term – i.e. within a year – the elimination of cheap primary and end products would drive prices in the USA up by a significant 5.5%. US producers would offer many goods that are actually intended for export at home, meaning that US exports would probably slump by almost 17%. US economic output would be reduced by 1.6% as a result of the trade war.

“By cutting itself off from the global market and without access to low-cost suppliers, the US is primarily harming itself because the benefits of the international division of labor are lost,” says Julian Hinz, Research Director for Trade Policy at the Kiel Institute for the World Economy.

China itself would be significantly less affected, with exports likely to fall by 4.75% and economic output by 0.7%. Domestic prices are likely to fall by 2.7% because products destined for export will face increased competition.

Trade war causes global damage

Globally, a trade war between the two largest economies is leaving its mark. Global production falls by 0.75%, prices rise by 0.7%. The costs for the EU and its member states, on the other hand, are manageable and would have little to no negative impact over the course of the year. The reason for this is that the US tariff regime applies to all countries worldwide, meaning that the EU and Germany will not experience any particular disadvantages.

The effects will be most noticeable for Germany due to its strongly foreign-oriented economy. Exports are likely to fall by just under 0.2% and economic output by a good 0.2% over the course of the year. Prices are likely to fall by a good 0.3%, again primarily because products destined for the global market are being offered domestically.

“Import glut” of Chinese goods: No competition for Germany

The fear of a “glut” of Chinese goods, which were previously exported to the USA and now represent additional competition for German and European exporters on the global market, is unfounded according to simulation calculations. On the one hand, a large proportion of the goods are now likely to be offered in China itself. Secondly, automotive engineering, steel and chemicals play a particularly important role for European and German exporters. However, China has only exported a small amount to the USA in these segments to date, barely 5% of the global trade volume.

Countries such as Vietnam, Cambodia and Bangladesh, which produce decorative items, Christmas decorations and textiles and are therefore in direct competition with China on the global market, tend to suffer from a “glut” of Chinese products. “Trade means prosperity. The EU must therefore now position itself as a reliable and open trading partner and not allow itself to be drawn into a global spiral of isolationism,” said Hinz.