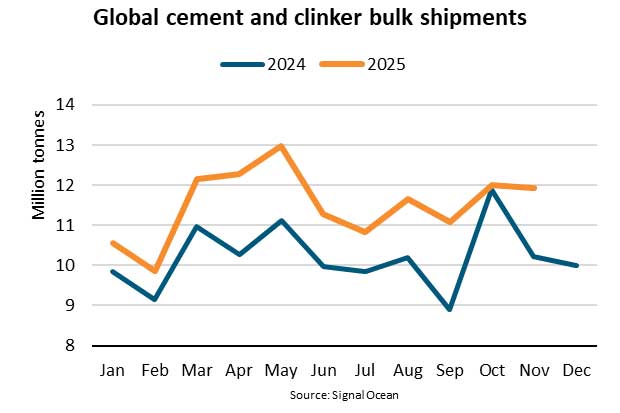

Significantly more cement was shipped on the world’s oceans this year than in 2024. The demand from one region in particular has contributed to this development.

Cement is still one of the most important building materials in the world, accounting for a significant proportion of global bulk shipping. Although there are efforts to replace cement – the production of which releases enormous amounts of emissions – with more climate-friendly building materials, global demand remains high: year-on-year, freight volumes increased by 13%.

Despite the import tariffs imposed by US President Trump, cement imports to the United States, for example, increased slightly. However, the actual growth is primarily attributable to the Africa region. According to the shipping organization Bimco, global growth is mainly concentrated on the African Atlantic coast: Imports there rose by 39% year-on-year. “The region is experiencing high economic growth, fast urbanisation and rapid development in infrastructure, supporting construction activity and boosting the demand for cement,” says Filipe Gouveia, Shipping Analysis Manager at Bimco.

Too little capacity in Africa

Most countries in the region are dependent on imports of cement as they have insufficient capacity for their own production. They are particularly limited when it comes to the intermediate product clinker. Even where cement plants are available, clinker still has to be imported, which leads to an increase in bulk freight.

Almost all shipments in this segment are transported by Supramax and Handysize vessels. According to Bimco figures, Supramax vessels account for around 60% of freight, while Handysize vessels account for 38%. “In total, these shipments accounted for 6% of demand for supramax ton-miles and 5% of demand for handysize ton-miles,” it says.

“Average sailing distances for cement and clinker shipments have increased so far this year, supported by stronger shipments from Asia to Africa’s Atlantic coast,” said Gouveia. “Consequently, tonne mile demand for cement and clinker shipments has grown 23% y/y, benefiting the supramax and handysize segments. Overall, cement and clinker shipments have accounted for 2% of dry bulk tonne mile demand this year.”

Vietnam remains world export champion

Away from the African markets, more cement was also delivered to East and Southeast Asia, as well as to Central and South America. Clinker deliveries remained stable year-on-year. Price competition in these markets has increased, as several Asian countries have overcapacity in their cement industry or weak domestic demand, which has led to an increase in low-price exports.

Chinese seaborne exports have more than doubled, rising 135% year-on-year, as domestic producers face declining construction activity due to the country’s housing crisis. In addition, Vietnam’s seaborne exports are up 16% year-on-year, maintaining the country’s position as the world’s largest exporter with a 27% share of shipments.

Tariffs cannot stop US demand

While exports from Asia are increasing, demand in the USA – the largest import market for cement – remains high. Despite the tariffs, imports here have risen by 3% year-on-year. According to the Bimco analysis, the tariffs imposed by Trump have not been enough to boost domestic cement production: clinker production actually fell by 7% between January and July 2025. Meanwhile, shipments to the US from the two largest exporters, Vietnam and Turkey, have risen by 27% and 14% year-on-year so far this year, despite tariff increases of 20 and 15 percentage points respectively.

“The outlook appears largely positive as rising African demand and high price competition amongst exporters could support cement and clinker shipments,” Gouveia said. “However, US building permits fell 5% y/y between January and August, indicating that US demand could slow in the short term.”