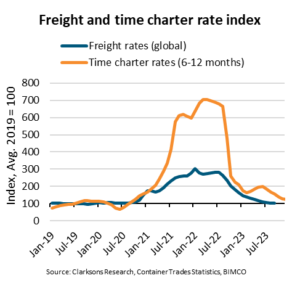

While freight rates in container shipping have fallen back to 2019 levels, charter costs remain significantly higher. However, market observers expect at least one factor to improve from a liner perspective.

Liner operators continue to struggle with a deteriorating balance between supply and demand, which is having an impact on freight rates. The average freight rate reached the 2019 level in September. On average, the fleet has grown by 5% since the beginning of the year compared to 2022 and by 19% compared to 2019. On the other hand, container volumes have fallen by 2% compared to 2022 and increased by only 1% compared to 2019. [ds_preview]

“However, the cost of chartering a ship is still 25% higher than in 2019,” says Niels Rasmussen, Chief Shipping Analyst at the shipping organization Bimco.

“Lower sailing speeds have reduced supply growth compared to 2022, but reduced port congestion has worked in the other direction. According to Container Trades Statistics’ aggregate price indices, average freight rates have fallen by 56% so far this year compared to last year, but were still 19% higher than in 2019. However, in September 2023, average freight rates were back to 2019 levels and have probably fallen further since then,” says Rasmussen.

Key cost items for liner shipping companies have not followed the rates

On the other hand, the most important cost items for the liner shipping companies have not followed the rates. Although the cost of very low sulphur fuel (VLSFO) has fallen by 29% compared to 2022, so far this year it has been 5% higher than in 2019. For ships with scrubbers, prices for HFO have fallen by 22% compared to 2022, but were 22% higher than in 2019.

“The average cost of chartering a new ship so far this year has fallen by 73% compared to last year, but is still 65% higher on average than in 2019 and in December still 25% higher than the 2019 average. The actual time charter costs of the liner shipping companies are even higher, as they are still paying at much higher rates for time charter contracts concluded in 2021 and 2022,” says Rasmussen. At this year’s HANSA Forum on November 30 in Hamburg, the CEO of the liner shipping company Hapag-Lloyd, Rolf Habben Jansen, also pointed out structurally higher costs compared to the pre-pandemic period.

On the other hand, the more profitable headhaul trades are developing better, with volumes achieved since the beginning of the year and current freight rates 6% and 16% higher than in 2019. “As we outlined in our recent ‘Container Shipping Overview & Outlook’ report, the fleet is expected to grow by a further 9% by 2024, putting further pressure on the market. Freight rate increases are therefore likely to be difficult to achieve, but time charter rates will probably continue to fall,” says Rasmussen.