The return to growth in global trade has also driven maritime trade. The fleet is growing, and scrapping is decreasing.

At the beginning of 2024, the global merchant fleet comprised 61,811 ships with a total capacity of 2.25 billion dwt, an increase of 3.6% compared to the previous year (ships of 300 GT and more). [ds_preview]

According to data from Clarksons Research, additions to the fleet reached the level of the beginning of this decade: 1,578 merchant ships with a total capacity of 84 million dwt were delivered. This corresponds to an increase of 5.3 % compared to the previous year in dwt. In the same period, only 347 merchant ships with a total capacity of 9.4 million dwt were sold for scrapping, which corresponds to a year-on-year decline of 15 %.

Clarksons Research expects maritime trade to grow by 3% in 2023, following a decline of just under 0.5% in the previous year. The experts are also forecasting growth for 2024, although this will be slightly lower at an estimated 2.1 %. “However, a closer look at the figures shows that container trade, in particular, is unlikely to have made a significant contribution to growth in 2023. In addition to the economic crisis, particularly in Europe and Asia, the focus here is also on political and environmental developments,” comments the Bremen Institute of Shipping Economics and Logistics (ISL) on the figures.

The decision by the major container shipping companies to no longer use the Suez Canal for Europe-Asia traffic due to the military conflicts in the Middle East and the attacks by the Houthi rebels on civilian shipping will have an impact on maritime trade, at least in the short term. The voyage, especially for container freighters, will therefore be extended by at least seven days per trip on the Asia-Europe route, as the only alternative is now to use the longer route around the Cape of Good Hope.

LNG tankers, container ships and carriers with large order books

At the same time, the drought in the Panama Canal continues to cause considerable logistical problems. As there is not enough fresh water available, the canal authority ACP has reduced the number of passages and limited the maximum draught.

“As the transportation of liquid and dry bulk goods does not usually pass through this bottleneck, it is practically unaffected. This is one of the reasons why the above-mentioned growth in maritime trade is primarily driven by dry bulk goods such as iron ore (+4.2 %), coal (+6.6 %) and grain (+4.1 %),” according to ISL. Together with the transportation of crude oil and oil products, these three types of goods account for just over 50% of global seaborne trade.

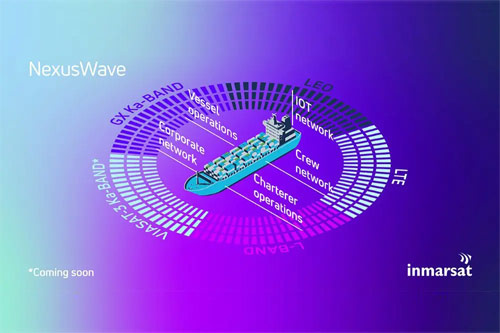

The boom in LNG, container and car carriers with rising charter and freight revenues is reflected in the newbuilding orders for 2021 and 2022. The ratio between order backlog and fleet in CGT is “remarkably high” for LNG carriers (46%), container ships (22%) and car carriers (20%), while the figures for oil tankers (4%) and bulk carriers (7%) are at a historic low.