2023 was a record year for newbuild deliveries in container shipping, but this year the “record” is likely to be surpassed again.

How much new construction can the global fleet take? And how many older ships will be decommissioned in view of increasing environmental regulations? There are a number of unanswered questions in container shipping[ds_preview].

According to the shipping organization Bimco, which is mainly supported by shipping companies, the industry is set for another record year: Over 30 million TEU of capacity could be available by the end of this year, according to the organization.

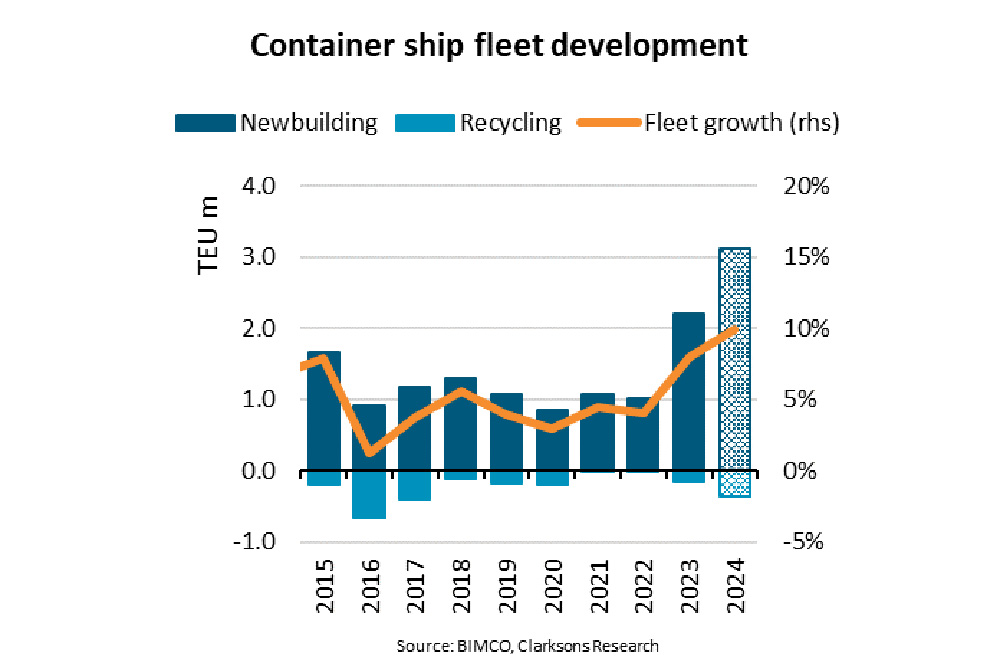

“In 2023, the shipyards delivered 350 new container ships with a total capacity of 2.2 million TEU, surpassing the previous record from 2015, when 1.7 million TEU were delivered. The record set in 2023 is now likely to be surpassed as early as 2024,” writes Bimco’s Chief Analyst Niels Rasmussen in an industry report today.

As relatively few container ships were recycled in 2023, the new ships entering the fleet led to an 8% increase in container fleet capacity, the fastest growth since 2011. Ships of more than 15,000 TEU continued to dominate deliveries and the segment grew by 28% after 1.3 million TEU were delivered in 2023.

“This year, 478 container ships with a capacity of 3.1 million TEU are to be delivered. The capacity of the container fleet is therefore expected to grow by 10% in 2024,” says Rasmussen.

New construction wave leads to new record

However, he also expects the recycling of ships to increase in 2024. Nevertheless, the fleet could still grow by almost 2.8 million TEU and exceed 30 million TEU for the first time in history by the end of 2024.

A further 83 ships larger than 15,000 TEU are expected to arrive in 2024, which would increase the segment’s capacity by 1.4 million TEU and double capacity in just four years.

China benefits the most

Chinese shipyards have benefited the most from the record-breaking orders, delivering almost 55% of the total ship capacity in 2023 and 2024, followed by South Korea with an expected 38% of the capacity.

Once all ships have been delivered, the capacity of the fleet would have grown by 10%. However, container traffic is expected to grow much more slowly, according to Bimco: “We assume that the increase in container volumes will increase demand for ship capacity by 3-4% in 2024.”

More slow steaming?

In the meantime, the average sailing speed of container ships has fallen from 14.3 knots in 2022 to 13.9 knots in 2023 and could fall further in 2024. This will also reduce the efficiency of the fleet, and 3 to 4 % additional capacity may have to be deployed to cope with the increase in volume in 2024.

“The imbalance between supply and demand will intensify in 2024. However, persistent disruptions in the Red Sea, forcing ships to sail via the Cape of Good Hope, could restore the balance between supply and demand,” writes Rasmussen. A further 3 million TEU are expected to be delivered in 2025-2026, “and unless recycling increases significantly, the market imbalance is likely to return once the situation in the Red Sea is resolved,” the analyst says.