The port of Antwerp-Zeebrugge ended the first quarter of 2025 with a total cargo throughput of 67.7 million tons.

This corresponds to a decline of 4% compared to the previous year. This was due to a slump in the bulk segment, while container traffic recorded growth.

The port continues to face challenges such as dynamic market trends, geopolitical tensions and ongoing pressure on the European chemical sector. With the United States being the second largest trading partner, the port operator Port of Antwerp-Bruges is looking to the coming months with increased vigilance, where the impact of the changing trade climate could become more noticeable.

Strong container throughput, volatile bulk segment

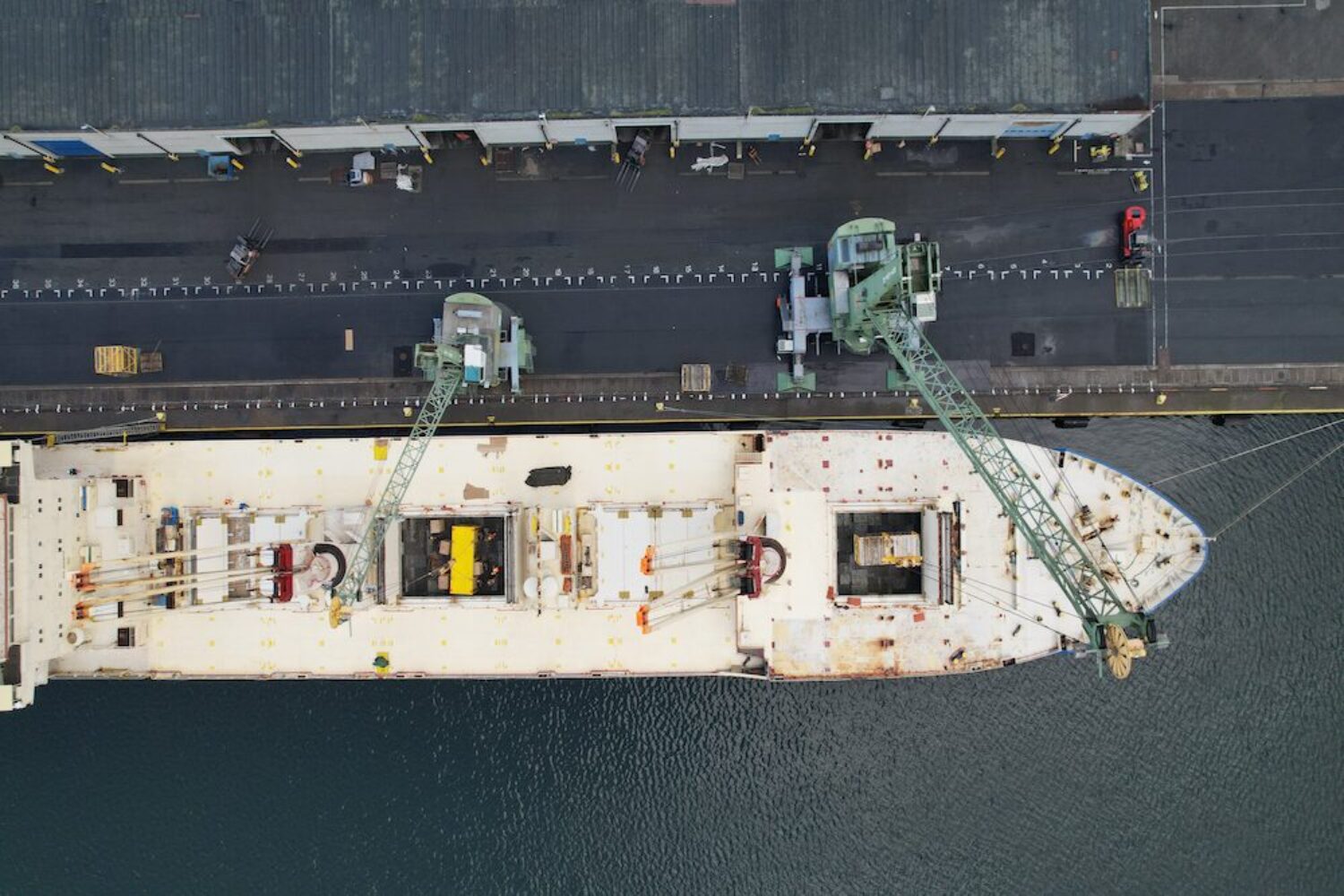

Container throughput proved to be the driving force in the first quarter. It recorded an increase of 4.6% in tonnage and 4.5% in TEU compared to the same period in 2024, despite geopolitical uncertainties and restructuring within the container alliances. The transition to the new alliances as well as strikes and bottlenecks in other ports led to longer dwell times for containers and thus to greater pressure on terminal capacity. Antwerp-Zeebrugge’s market share in the Hamburg-Le Havre range rose to 30.5%, and the port climbed from 15th to 14th place in the ranking of the world’s largest container ports.

The most significant decline in the first quarter concerned liquid bulk (-19.1%), with petrol, naphtha and LNG in particular falling sharply. The reasons for this include changed market conditions in Africa, lower demand for naphtha from the petrochemical industry and the EU sanctions against Russian LNG transit. The throughput of chemicals rose by 10.9%, mainly due to the strong increase in biofuels (+128%), despite the ongoing pressure on the European chemical sector.

In other segments, the impact of the difficult market conditions remained limited. Breakbulk, for example, recorded a slight decline (-5.4%) due to lower iron and steel throughput (-14.3%) as a result of the weak economy and import quotas. RoRo handling increased slightly (+1.1%), although the handling of new cars fell sharply (-11.3%), reflecting the difficult situation in the European automotive industry. The decline in vehicle throughput was offset by an increase in other RoRo freight, such as unaccompanied freight. Dry bulk cargo remained almost stable (-0.8%).

Impact of US import tariffs limited for the time being

The impact of the US import tariffs on the port’s traffic remains limited for the time being. Although some companies are acting with foresight, no significant acceleration in exports to the USA can be seen so far. Container exports rose by 3.2%, steel experienced a temporary peak in January and vehicle shipments remained stable thanks to an increase in used cars and trucks.

At the same time, structural factors such as schedule disruptions in container liner traffic, changes in car market models and temporary production suspensions are increasing the pressure on terminals. Even if the immediate effects remain limited for the time being, it is clear that further developments in trade tariffs could affect the logistics chain in the coming months.

Structural challenges require cooperation

In addition to the trade tensions with the United States, the European economy, and the industry in particular, is struggling with structural problems that seriously jeopardize its competitiveness. High energy and production costs, global overcapacity and increasing competition from cheap imports, among other things, are putting the sector under pressure. In addition, complex regulations, slow approval procedures and high labor costs make it difficult to invest.

The combination of these factors has led to a sharp decline in market share, added value and production capacity in recent years. The operators Port of Antwerp-Bruges and Port of Rotterdam are therefore calling for a swift implementation of the Clean Industrial Deal with concrete measures and sufficient financial support to promote the resilience and future prospects of the European industry.

In addition, the logistics chain remains vulnerable. The pilot strike on March 31 temporarily closed access to the port, causing millions of euros in economic damage and having a visible impact on the operations and image of Port of Antwerp-Bruges. This disruption affected several links in the chain, from shipping companies and terminals to industry and transport. With another nationwide strike planned for April 29, uncertainty remains high. The structural challenges combined with increasing trade pressure from the United States underline the need for dialog and cooperation.

It is almost impossible to predict handling trends

“We are going through particularly uncertain times, so it is difficult to predict what 2025 will bring,” says Jacques Vandermeiren, CEO of Port of Antwerp-Bruges. “But as in previous crises, our port is proving to be resilient and reliable.” This stability is crucial, both for customers and for the economy as a whole. At the same time, the protectionist measures taken by the United States have made it clear that Europe needs a robust economic policy to strengthen our industry and consolidate our strategic position.

Johan Klaps, Deputy Mayor of the City of Antwerp and Chairman of the Board of Directors of Port of Antwerp-Bruges: “The strong container traffic underlines the importance of continuous investment in our port infrastructure. Projects such as ECA (Extra Container Capacity Antwerp) are essential to take steps towards sustainable growth, space efficiency and improved competitiveness. Important measures will be taken in this regard in the coming months. I would like to take this opportunity to thank all port employees for their commitment and flexibility in recent times, including during the recent strike. Our great port staff are undoubtedly among the best in the world.”

Dirk De fauw, Mayor of Bruges and Vice Chairman of the Board of Directors of Port of Antwerp-Bruges: “These quarterly figures demonstrate the value of the complementarity between Antwerp and Zeebrugge. The combination of economies of scale and specialization proves itself time and again, especially in a turbulent international climate. Through close cooperation and joint investment in infrastructure and innovation, we are continuing to build a strong, integrated port for the whole of Flanders. For example, we look forward to the Oosterweel tunnel elements being transported from Zeebrugge to Antwerp in the near future.”