While 2024 was still dominated by the crisis in the Red Sea and high demand on the primary trade routes, shipping companies have recently withdrawn more capacity.

In 2024, global trade routes were dominated by attacks by the Houthi militia in the Red Sea. The crisis forced many shipping companies to avoid the Suez Canal and instead take the longer route around the Cape of Good Hope. The extra time also tied up additional tonnage. In order to cope with the crisis, large volumes of capacity had to be concentrated on the Asia-Europe route. Current data shows that this development has now come to an end: In 2025, secondary trade routes in particular have benefited.

According to the industry service provider Sea-Intelligence, a “new phase” was observed in the second half of the year. The company tracked the data of 16,000 ship transfers in 2024 and 2025 and was able to derive a “cascade effect” from the shift. According to this, the primary trade routes are saturated in terms of capacity, so shipowners are once again providing more volume on additional routes.

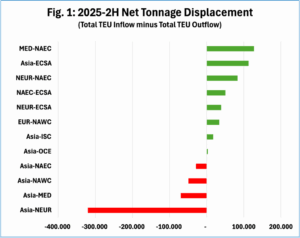

The figure shows the net gain and loss on the individual routes. The result is calculated from the accumulated inflows and outflows of capacity in TEU.

- Asia-NEUR: -319.804

- Asia-MED: -69,906

- Asia-NAWC: -49,136

- Asia-NAEC: -28,713

- Asia-OCE: 3,089

- Asia-ISC: 17,574

- EUR-NAWC: 33,776

- NEUR-ECSA: 38,899

- NAEC-ECSA: 50,490

- NEUR-NEAC: 83,047

- Asia-ECSA: 112,998

- MED-NAEC: 127,686

Abbreviations of the trading regions: Asia, NEUR (Northern Europe), MED (Mediterranean), NAWC (North American West Coast), NAEC (North American East Coast), OCE (Oceania), ISC (Indian Subcontinent), ECSA (South American East Coast)

Capacity withdrawn from Asia and Northern Europe

As the data shows, the shipping companies have recently removed more capacity from the primary connections. The biggest “loser” is the Asia-North Europe route with almost -320,000 TEU, followed by routes from Asia to the Mediterranean and to both coasts of North America. Additional capacity flowed primarily into connections between the Mediterranean and the east coast of North America (approx. +128,000 TEU) and between Asia and South America (approx. +113,000 TEU). According to Sea-Intelligence, there is a correlation between the two extremes: eleven ships from Asia-Mediterranean routes, each with 14,000 and 15,000 TEU, are now sailing between the Mediterranean and America; a total of 178,189 TEU were shifted.

The capacity on the Asia-South America trade lane – the second largest gainer – is mainly made up of ships with 8,000 to 14,000 TEU. These were withdrawn from the most important East-West routes.

“The data supports this as a permanent structural change, as 97% of the ships diverted to the Asia-East Coast South America route during this period did not return to their previous trade routes,” says Sea-Intelligence. “This indicates that the excess capacity originally triggered by the Red Sea crisis is now effectively utilizing the peripheral trade routes of the global network.”

The extent to which a full return of shipping companies to the Red Sea will affect capacity remains questionable. Although the primary connections are currently fully utilized, the Asia-North Europe route in particular is still tying up additional capacity due to the detour. If more ships are able to sail through the Red Sea and the Suez Canal again (and CMA CGM and Maersk were recently considering this), European ports at least would have to prepare for long-term overcapacity and thus congestion. (JW)