On the Asia-North Europe and Asia-North America East Coast routes, the number of cancelled capacities has fallen sharply in recent weeks. A similar trend towards fewer blank sailings can be observed on the Asia-Mediterranean route.

Spot rates have been falling continuously for several months. The shipping companies could, therefore, increase the number of blank sailings in order to reduce supply and halt the decline in spot rates. But the trend is different. [ds_preview]

On the Asia-North Europe and Asia-North America East Coast routes, the number of cancelled capacities has fallen sharply in recent weeks. According to Sea-Intelligence, a similar trend can be observed on the Asia-Mediterranean route. “However, given the high volatility in this trade, it is still too early to determine whether this is a new trend or simply part of the usual high volatility,” it says.

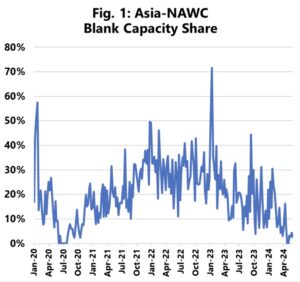

On the Asia-North America-West Coast route, however, a “clear systematic trend” has been evident since 2022 and will continue until 2024. The number of blank sailings is now almost zero. “Even if we take a four-week average to smooth out the fluctuations in all four sailing areas, the underlying trend is the same, i.e. a sharp decline in blank sailings in recent weeks,” says Sea-Intelligence.

This suggests that the decline in spot rates per se is not the point, as current spot rates are significantly higher than before the Red Sea crisis and the pandemic. “With this in mind, and given the data on empty sailings, it seems that in the current market environment, shipping companies are trying to capitalise as much as possible on the relatively higher rates by not restricting their capacity. However, the likely outcome will be continued downward pressure on spot rates,” the analysts estimate.