The acceptance of new fuels is growing, as a glance at the current order book clearly shows. 45% of all orders by tonnage are for alternative fuels.

“2023 was a very important year for the decarbonization of the shipping industry as new regulations came into force and the IMO agreed a net zero commitment. And although we are only at the beginning of a vital and unprecedented fleet renewal investment program, a start has been made: 49% of current order book tonnage is now powered by alternative fuels,” explains Steve Gordon, Global Head of Clarksons Research on the publication of the latest Green Technology Tracker. [ds_preview]

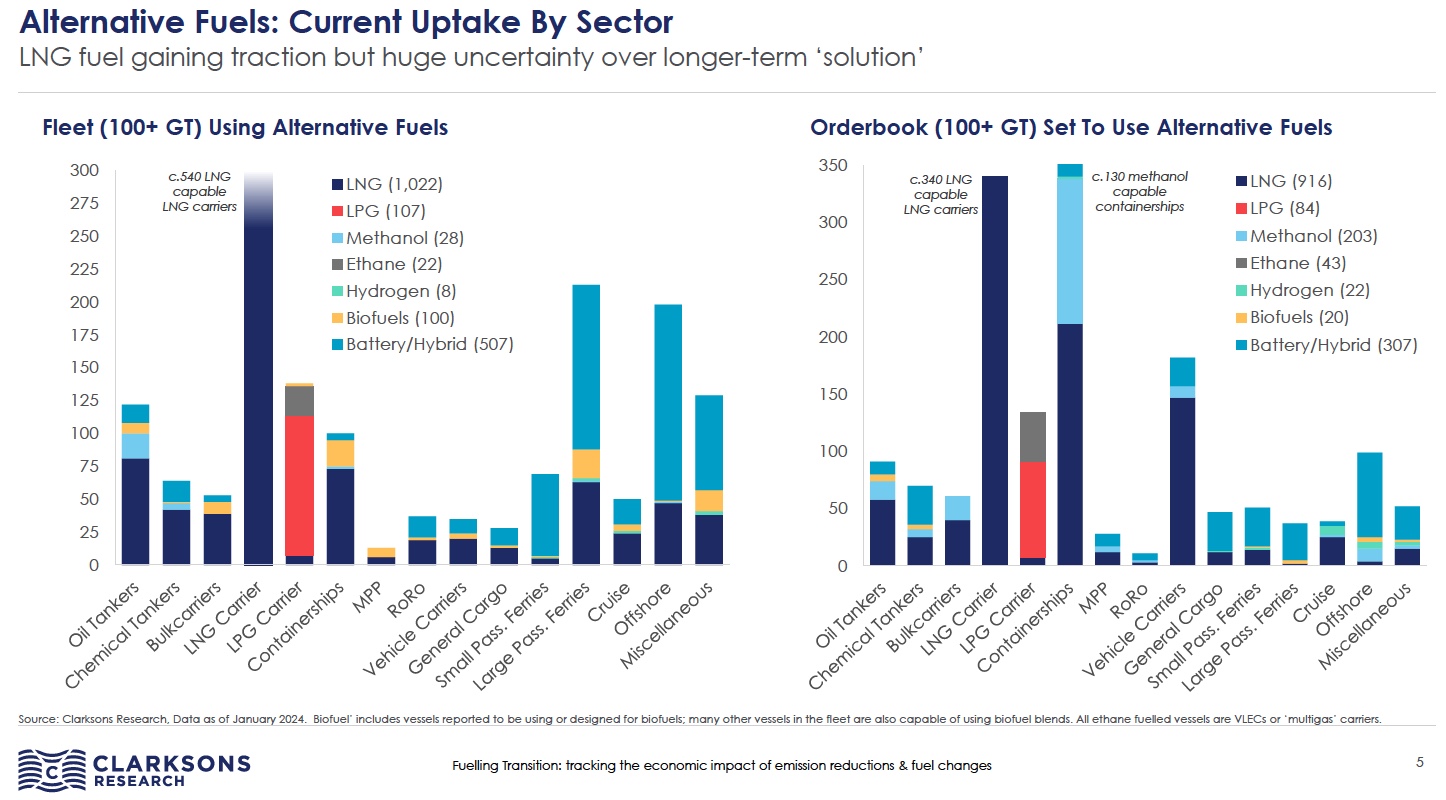

For the year 2023, Clarksons market observers recorded 539 newbuilding orders for ships with a total of 33.8 million GT designed for alternative fuels, which corresponds to 45% of all orders by tonnage. LNG dual-fuel vessels continue to account for the largest share of orders for alternative fuel vessels in 2023 (220 orders, of which 152 were non-LNG carriers), but with an increase to 125 orders for methanol dual-fuel vessels in 2023. There were also 55 new orders for LPG as a fuel and four for ammonia. In terms of future “optionality”, 579 ships in the fleet and in newbuilds have “LNG ready” status, 322 have “ammonia ready” status and 272 have “methanol ready” status.

Alternative fuels more or less widespread depending on segment

Acceptance also varies in the individual shipping segments: 83% of new container ship capacity ordered this year (94% including orders with “ready” status) and 79% of car carriers ordered (98% including orders with “ready” status) have the ability to run on alternative fuels, while the proportion is significantly lower for bulk carriers and tankers. “Overall, 6% of global fleet capacity can run on alternative fuels today (up from 2.3% in 2017), and we expect this to rise to almost a quarter of total fleet capacity by the end of the decade (2030(f):~23%),” says Clarksons.

However, Clarksons Research is not only looking at alternative fuels in the Green Technology Tracker, but also at other technologies that make ships “greener”. “Eco” ships now account for 32% of global tonnage (even 50% for VLCCs and Capesize), and the use of innovative energy-saving technologies (ESTs) continues to grow (~7,295 ships in the fleet have “significant” ESTs, including 47 wind-powered vessels, according to Clarksons’ analysis). The Green Technology Tracker also includes 31 vessels in the fleet (plus 22 newbuildings) testing onboard carbon capture technology (CCS). “Given an ageing fleet (12.6 years, up from 9.7 years ten years ago) and our observation of ship performance according to the CII in 2023, according to which more than 30% of tonnage will be rated D or E, further investment in the existing fleet will be crucial,” it says.

The number of SOx scrubbers has also increased year-on-year (in total, including upcoming retrofits, over 5,590 vessels in the fleet, 27% of global fleet capacity), with 420 vessels being retrofitted with a scrubber in 2023 and 321 newbuilds with scrubbers on order. Bimco also estimates that more than 80% of global tonnage is now equipped with a BWMS.