Although shipping is exposed to more risks worldwide, the number of accidents has reached a new low.

While 30 years ago, there were still around 200 large ships wrecking every year, in 2023, there were only 26. This record low represents a decrease of more than a third compared to 2022 (41) and more than 70% compared to 2013 (729). However, the latest Safety and Shipping Review by Allianz Commercial also shows that the industry is facing numerous challenges. These include the dangers of war and geopolitical tensions, the consequences of climate change and the increasing pressure to transform fleets to be more green. [ds_preview]

“Conflicts such as those in Gaza and Ukraine are changing global shipping, impacting crew and ship safety, supply chains and infrastructure, and even the environment. Piracy is on the rise, particularly in the Horn of Africa, while ongoing disruptions caused by drought in the Panama Canal show how climate change is affecting shipping. These additional risks come at a time when the industry is facing its biggest challenge, decarbonisation,” says Captain Rahul Khanna, Global Head of Marine Risk Consulting, at Allianz Commercial.

Highest risk of accidents in Southeast Asia

In the last ten years, 729 total losses have been reported. The maritime region of Southeast Asia is the global hotspot with 184 accidents both last year and in the last decade. It accounted for almost a third of the ships lost last year (8). In second place are the Eastern Mediterranean and the Black Sea with six losses. The number here has risen compared to the previous year. Cargo ships again accounted for over 60% of the ships lost worldwide in 2023. With a share of 50%, sunken ships were the main cause of all total losses. Extreme weather conditions were responsible for at least eight ship losses worldwide, although the number of unreported cases is probably higher.

The number of accidents reported worldwide fell slightly last year (2,951 compared to 3,036), with the British Isles recording the highest number (695). The number of fires on board ships also fell: 205 fires were reported in 2023. However, with 55 total losses in the last five years, fires remain a key safety issue on larger vessels.

Shipping increasingly vulnerable to geopolitical conflicts

According to Allianz, recent incidents such as the war in the Gaza Strip illustrate the increasing vulnerability of global shipping to geopolitical conflicts. In the Red Sea alone, more than 100 ships have been attacked by Houthi rebel militants in response to the conflict. “The disruption to shipping in the region will continue for the foreseeable future. Increasing attacks by Somali pirates are a further cause for concern,” it says.

“Drones, as a new technology, are an increasing threat to merchant shipping. They are cheap, easy to manufacture and difficult to defend against without naval protection,” says Khanna. “Further technology-based attacks on shipping and ports are entirely conceivable. Reports of GPS jamming on ships are increasing, especially in the Strait of Hormuz, the Mediterranean and the Black Sea.”

Shadow fleet of 600 to 1,400 ships

Since Russia’s invasion of Ukraine, the gradual tightening of international sanctions against Russian oil and gas exports has contributed to the growth of a considerable “shadow fleet” of tankers. This now comprises between 600 and 1,400 ships, which have been involved in at least 50 incidents to date, including fires, engine failures, collisions, loss of control and oil spills.

“These are mostly older, poorly maintained vessels, operating outside international regulations and often without adequate insurance. This poses serious environmental and safety risks,” says Justus Heinrich, Head of Marine Insurance in Germany and Switzerland at Allianz Commercial. “The costs of these incidents often fall on the governments or insurers of the other ships.”

Longer routes = more risks

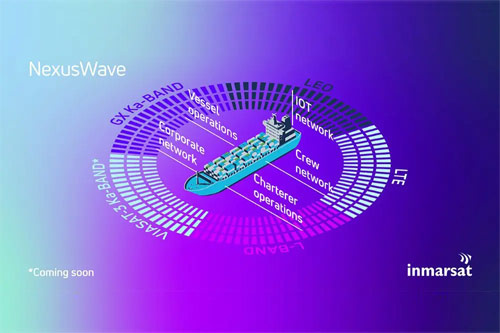

The attacks on shipping in the waters of the Middle East have also severely impacted transit traffic on the Suez Canal and trade. This has slumped by more than 40 % since the beginning of 2024. Shortly after the ongoing disruptions caused by the drought in the Panama Canal, this was a double blow for shipping. Global supply chains are thus facing a further stress test, as long detours and higher costs result regardless of the alternative routes. For example, bypassing the Suez Canal via the Cape of Good Hope adds at least 3,000 nautical miles (over 5,500 kilometres) to the journey time, which corresponds to around ten days.

The detours also have an impact on the risk landscape and the environment. Storms and rough seas can be more challenging for smaller vessels that normally navigate coastal waters. Support infrastructure if the largest vessels are involved, such as a suitable port of refuge, may not be available. To minimise the time lost due to the detour, the diverted ships increase their speed. This, in turn, leads to higher emissions: Detours due to the situation in the Red Sea are already cited as one of the main reasons for the 14% increase in emissions in the EU shipping sector this year.

Environmental challenges, limited shipyard capacity

The shipping industry contributes around 3% of global greenhouse gas emissions each year and has set itself strict targets to reduce these emissions. Achieving these targets will require a mix of strategies, including measures to improve energy efficiency, the introduction of alternative fuels and innovative ship designs and propulsion methods.

Accordingly, decarbonisation poses various challenges for the industry: It must develop an infrastructure that supports the operation of ships using alternative fuels while phasing out fossil fuels. There are also potential safety issues for port operators or ship crews when handling alternative fuels, which can be toxic or highly explosive, says the alliance.

“Increasing shipyard capacity will be crucial as demand for greener ships increases. These capacities are currently limited by long waiting times and high construction prices,” says Heinrich. By 2050, over 3,500 ships will need to be built or refitted every year, but the number of shipyards has more than halved between 2007 and 2022. “Capacity bottlenecks at the shipyards can have an impact on repairs and maintenance. Damaged ships can, therefore, be subject to long delays.” Engine damage or failure is the most common cause of shipping accidents, accounting for more than half of accidents worldwide in 2023 (1,587).